Repo Tow Trucks For Sale Near Me: Your Comprehensive Guide to Smart Acquisitions pickup.truckstrend.com

The world of commercial vehicles often presents a paradox: the need for specialized, heavy-duty equipment versus the significant upfront cost. For entrepreneurs looking to start or expand a towing business, or even established companies seeking to grow their fleet economically, the phrase "Repo Tow Trucks For Sale Near Me" can be a beacon of opportunity. These repossessed vehicles offer a unique pathway to acquiring essential assets at a fraction of the cost of new models. But what exactly are they, where can you find them, and what crucial steps should you take to ensure a smart purchase? This detailed guide will navigate you through the landscape of repossessed tow trucks, offering practical advice and actionable insights.

What Exactly Are Repo Tow Trucks? Unpacking the Repossession Process

Repo Tow Trucks For Sale Near Me: Your Comprehensive Guide to Smart Acquisitions

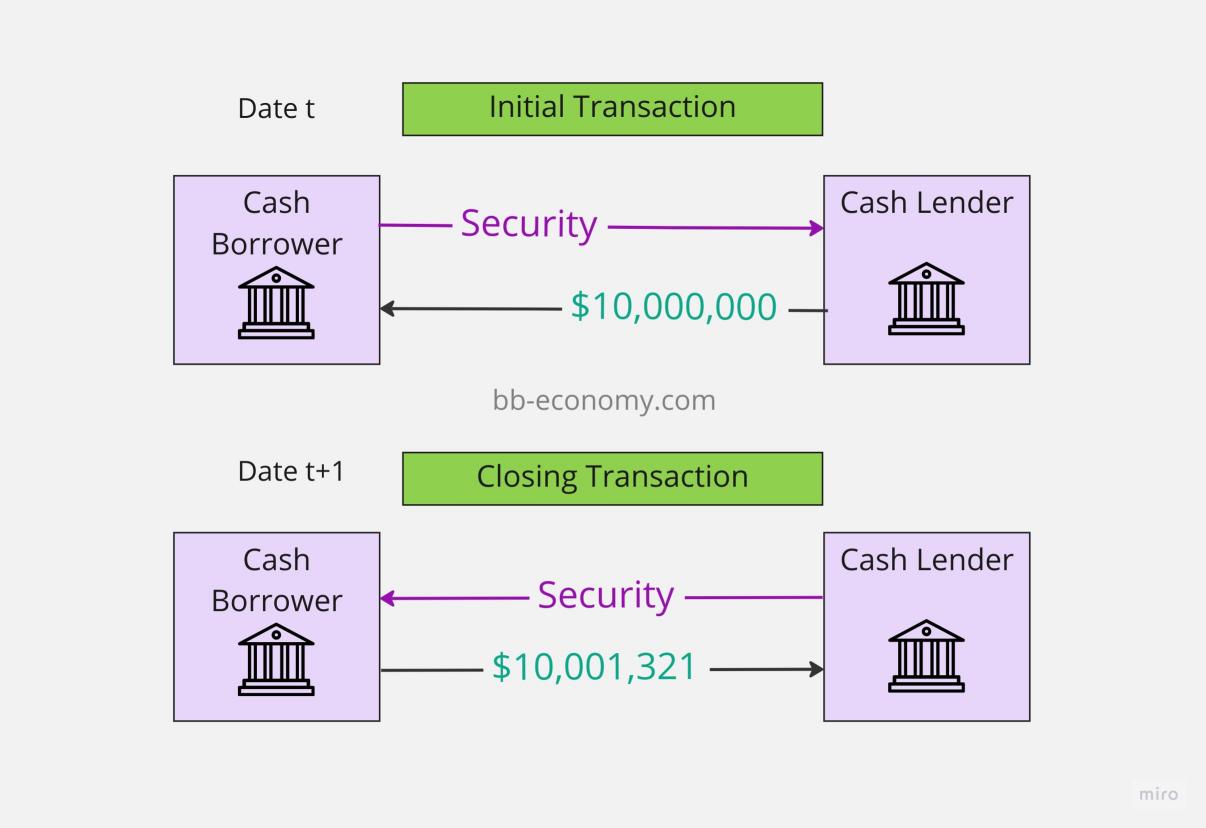

A "repo tow truck" is simply a tow truck that has been repossessed by a lender. This occurs when the original owner defaults on their loan payments, leading the financing institution (a bank, credit union, or private lender) to reclaim the asset to mitigate their financial losses. Once repossessed, these vehicles are then typically sold off to recover the outstanding debt.

The allure of these trucks lies in their potential affordability. Lenders are generally not in the business of holding onto vehicles; their primary goal is to liquidate the asset quickly to recoup as much of the loan as possible. This urgency often translates into competitive pricing for buyers. Unlike vehicles involved in accidents or those that have reached the end of their service life, repossessed tow trucks are often in functional condition, having been actively used by their previous owners until the point of default. They might require some maintenance or minor repairs, but frequently, they are ready to be put back into service with minimal fuss.

The Allure of Repossessed Tow Trucks: Benefits and Critical Considerations

The decision to purchase a repossessed tow truck comes with a distinct set of advantages, but also necessitates careful consideration.

Key Benefits:

- Significant Cost Savings: This is by far the biggest draw. Repo trucks are almost always priced significantly lower than comparable new or even conventionally used models. This can free up capital for other business expenses, marketing, or expansion.

- Immediate Availability: Unlike ordering a new truck which can involve manufacturing and delivery delays, repossessed trucks are typically available for immediate purchase and deployment. This is crucial for businesses needing to scale up quickly.

- Potential for High Value: Many repossessed trucks are relatively late models or well-maintained units. If you conduct thorough due diligence, you can unearth a fantastic deal on a truck that still has many years of service left.

- Wider Selection: The repo market can offer a diverse range of tow truck types – from light-duty wheel-lifts to heavy-duty rotators – giving buyers more options than they might find at a traditional dealership.

Critical Considerations:

- "As-Is" Condition: The vast majority of repo sales are "as-is, where-is." This means no warranties, no guarantees, and no recourse if issues arise after purchase. Comprehensive inspection is paramount.

- Unknown History: Service records may be difficult or impossible to obtain, making it challenging to ascertain the vehicle’s maintenance history or any underlying mechanical issues.

- Cosmetic Imperfections: While mechanically sound, some repo trucks might have cosmetic damage, wear and tear, or even personalizations from the previous owner that need to be addressed.

- Competitive Market: Good deals on repo trucks don’t last long. You’ll often be competing with other savvy buyers, requiring quick decision-making once you’ve found a suitable option.

Types of Tow Trucks You Might Find in the Repo Market

The repo market can yield various types of tow trucks, each suited for different operations. Understanding these types will help you narrow your search:

- Light-Duty Tow Trucks (Wheel-Lift & Hook-and-Chain): These are the most common and often the most frequently repossessed. They are ideal for passenger cars, light trucks, and motorcycles. Wheel-lifts lift the vehicle by its wheels, while hook-and-chain use chains to secure and lift the vehicle’s axle or frame. They are versatile for roadside assistance, impounds, and minor recovery.

- Medium-Duty Tow Trucks (Flatbed/Rollback): Highly versatile, flatbeds feature a hydraulic bed that tilts and slides back to allow a vehicle to be driven or winched onto it. They are excellent for transporting damaged vehicles, luxury cars, all-wheel-drive vehicles, or even small equipment. Their versatility makes them popular, and thus, they appear regularly in repo sales.

- Heavy-Duty Tow Trucks (Integrated & Rotators): Designed for large commercial vehicles like semi-trucks, buses, and RVs. Integrated tow trucks combine the boom and under-reach into a single unit for immense lifting power. Rotators have a boom that can swivel 360 degrees, ideal for complex recoveries in tight spaces. While less common in the repo market due to their specialized nature and higher initial cost, finding a repossessed heavy-duty unit can represent enormous savings.

Where to Find Repo Tow Trucks For Sale Near You

Finding these elusive deals requires knowing where to look and being proactive. Here are the most effective avenues:

-

Online Auction Platforms:

- GovDeals: Often features government-owned surplus, including repossessed or seized vehicles.

- Copart & IAAI (Insurance Auto Auctions): While primarily known for salvage vehicles, they frequently list repossessed or impounded vehicles, including tow trucks, sometimes in excellent condition.

- eBay Motors: A general marketplace where individuals and dealers list vehicles, including repossessed ones. Use specific search terms like "repo tow truck" and filter by location.

- Specialized Commercial Vehicle Auction Sites: Websites dedicated to commercial trucks and equipment often have sections for repossessed assets.

-

Bank and Lender Websites (Direct Sales):

- Many financial institutions, particularly those specializing in commercial vehicle loans, have "repo" or "asset recovery" sections on their websites. These direct sales can sometimes offer better prices as there are no auction fees. Check local and national bank sites.

-

Local Auction Houses:

- Physical auto auctions or specialized equipment auctions in your region often receive inventory directly from banks and credit unions. Attending these allows for in-person inspection, which is invaluable.

-

Used Commercial Truck Dealerships:

- Some dealerships specialize in used commercial vehicles and might acquire repossessed trucks through auctions or direct purchases. While their prices might be slightly higher than a direct repo sale, they often offer some level of reconditioning or limited warranties.

-

Government Surplus Sales:

- Local police departments, sheriffs’ offices, or state agencies sometimes auction off impounded or surplus tow trucks. Check their official websites or local government auction listings.

-

Networking:

- Talk to local tow truck operators, mechanics, and industry professionals. They often know about upcoming sales or trucks that are about to be repossessed.

Tip for "Near Me" Searches: When searching online, always utilize location filters effectively. On auction sites, input your zip code or state. For general searches, append "near me" or your city/state to your search query (e.g., "repo tow trucks for sale Atlanta GA").

The Buying Process: A Step-by-Step Guide to Smart Acquisition

Purchasing a repo tow truck isn’t just about finding the lowest price; it’s about making an informed decision.

Step 1: Research and Budgeting

- Define Your Needs: What type of towing will you primarily do? What capacity do you need?

- Set a Realistic Budget: This includes not just the purchase price but also potential repair costs, transportation, taxes, registration, and insurance. Factor in a contingency fund for unexpected issues.

Step 2: Finding Opportunities

- Actively monitor the sources mentioned above. Set up alerts on auction sites for new listings. Be patient but ready to act quickly when a promising opportunity arises.

Step 3: Due Diligence and Inspection (The Most Critical Step)

- Get the VIN: Obtain the Vehicle Identification Number as early as possible.

- Run a Vehicle History Report: Services like Carfax or AutoCheck can reveal accident history, previous ownership, odometer discrepancies, and reported liens.

- Pre-Purchase Inspection (PPI) by a Mechanic: If possible, arrange for a qualified, independent mechanic specializing in commercial trucks to inspect the vehicle. This is non-negotiable for "as-is" sales.

- What to Inspect:

- Engine & Transmission: Check for leaks, unusual noises, smooth shifting.

- Hydraulics: Test the boom, winch, and wheel-lift functions. Look for leaks, slow operation.

- Frame & Undercarriage: Inspect for rust, cracks, or signs of structural damage.

- Tires: Check tread depth, uneven wear, and overall condition.

- Brakes: Test functionality and inspect pads/rotors.

- Electrical System: Ensure all lights, gauges, and auxiliary systems work.

- Fluid Levels: Check oil, coolant, transmission fluid, and hydraulic fluid.

- Cab Interior: Look for excessive wear, damaged seats, or missing components.

- Winch & Cables: Ensure the winch operates smoothly and the cable is in good condition.

- What to Inspect:

- In-Person Viewing: Even if a mechanic does a PPI, visit the truck yourself if feasible. Look for anything missed, start the engine, and get a feel for the vehicle.

Step 4: Bidding or Negotiation

- Auction Strategy: Set a maximum bid beforehand and stick to it. Don’t get caught in a bidding war. Factor in buyer’s premiums and other auction fees.

- Direct Sales: Don’t be afraid to negotiate. Banks often want to move assets quickly, so there might be room for a lower offer.

Step 5: Financing and Paperwork

- Secure Financing: If needed, arrange financing beforehand. Lenders might be more cautious with "as-is" repo vehicles.

- Title Transfer: Ensure you receive a clear title free of any liens. Verify the VIN on the title matches the truck.

- Registration & Insurance: Factor in the cost and time for registration and commercial vehicle insurance.

Step 6: Transportation

- Plan how you will get the truck from the sale location to your base of operations. This might involve driving it yourself (if roadworthy and insured) or arranging for professional transport.

Important Considerations Before You Buy

- The "As-Is" Reality: Understand that you are accepting all risks. Any repair costs are entirely your responsibility.

- Maintenance History: While often unavailable, try to glean clues from the vehicle’s appearance, the condition of fluids, and the general cleanliness of the engine bay. A well-maintained appearance can be a good sign.

- Hidden Costs: Budget for potential major repairs (engine, transmission, hydraulic pump), tire replacement, detailing, and any specific equipment upgrades you might need.

- Legal and Licensing: Ensure you have the proper driver’s license (e.g., CDL for heavier trucks) and understand all local, state, and federal regulations for operating a commercial tow truck.

- Resale Value: A well-chosen and well-maintained repo truck can retain its value. Keep good service records once you own it.

Price Table: Sample Repo Tow Truck Price Ranges (Estimates)

Please note: Prices for repossessed tow trucks are highly variable and depend on numerous factors, including the truck’s specific make, model, year, mileage, mechanical condition, cosmetic state, location, and the urgency of the sale. This table provides estimated ranges for a general understanding.

| Truck Type | Condition (General) | Estimated Repo Price Range (USD) | New Price Range (USD) | Key Considerations for Repo Buyers |

|---|---|---|---|---|

| Light-Duty | Poor/Fair | $8,000 – $25,000 | $40,000 – $80,000 | Expect significant wear, potential mechanical issues. Best for budget buyers. |

| (Wheel-Lift, Hook) | Good | $25,000 – $45,000 | May need minor repairs, but generally road-ready. | |

| Medium-Duty | Poor/Fair | $20,000 – $45,000 | $80,000 – $150,000+ | Higher potential for major repairs. Inspect hydraulics meticulously. |

| (Flatbed/Rollback) | Good | $45,000 – $80,000 | Good value, likely requires standard maintenance, possibly cosmetic fixes. | |

| Heavy-Duty | Poor/Fair | $40,000 – $90,000 | $150,000 – $350,000+ | High risk without thorough inspection. Significant repair costs possible. |

| (Integrated, Rotator) | Good | $90,000 – $180,000 | Rare finds, but massive savings if mechanically sound. Focus on boom integrity. |

Disclaimer: These are general estimates. Always conduct a thorough pre-purchase inspection and due diligence before making any purchase decision. Prices can fluctuate wildly based on market demand, location, and specific vehicle details.

Frequently Asked Questions (FAQ) About Repo Tow Trucks

Q1: Are repo tow trucks always cheaper than other used tow trucks?

A1: Generally, yes. Lenders prioritize quick liquidation over maximizing profit, often leading to lower prices than what you’d find at a typical used truck dealership. However, the true "cheapness" depends on the condition and potential repair costs. A "cheap" truck with major mechanical issues can quickly become expensive.

Q2: Can I get financing for a repossessed tow truck?

A2: Yes, but it might be more challenging than financing a new or certified used truck. Lenders specializing in commercial vehicle loans may offer financing for repo trucks, but they might require a larger down payment or offer higher interest rates due to the "as-is" nature of the sale. Shop around for specialized lenders.

Q3: What are the absolute must-dos during an inspection of a repo tow truck?

A3: Hire an independent, experienced commercial truck mechanic for a Pre-Purchase Inspection (PPI). Focus on the engine (start it cold if possible), transmission (smooth shifts, no grinding), hydraulic system (test all functions of the boom, winch, wheel-lift; check for leaks), frame (look for rust, cracks, bends), and tires (condition, even wear). Also, check all lights, gauges, and the PTO (Power Take-Off) engagement.

Q4: Do repossessed tow trucks come with any warranty?

A4: Almost never. Repo sales are typically "as-is, where-is," meaning you buy the truck in its current condition with no guarantees from the seller. This is why a thorough inspection is critical.

Q5: How quickly do I need to act if I find a good deal on a repo tow truck?

A5: Good deals, especially on desirable models or those in good condition, can move very quickly. Be prepared to make a decision and act swiftly once your due diligence (especially the inspection) is complete. Have your financing pre-approved or funds readily available.

Q6: Is buying a repo tow truck a good idea for a new towing business?

A6: It can be an excellent strategy for a new business with a limited budget. It allows you to acquire essential equipment at a lower entry cost. However, it also demands a higher level of risk assessment and the discipline to invest in a thorough inspection and potential immediate repairs. It’s not for the faint of heart, but it can provide a significant competitive advantage.

Conclusion: A Strategic Path to Fleet Expansion

Navigating the market for "Repo Tow Trucks For Sale Near Me" presents a unique blend of opportunity and challenge. For the savvy buyer, it offers a strategic pathway to acquiring valuable assets at a considerable discount, enabling fleet expansion or business launch without the prohibitive costs of new equipment. However, success in this arena hinges entirely on a commitment to rigorous due diligence, particularly a comprehensive pre-purchase inspection by a trusted mechanic.

While the "as-is" nature of these sales requires caution and a realistic budget for potential repairs, the rewards—in terms of cost savings and immediate operational capacity—can be substantial. By understanding the types of trucks available, knowing where to search effectively, and meticulously following a structured buying process, you can transform the perceived risk of a repossessed vehicle into a smart, financially sound investment that drives your towing business forward.