Repo Pickup Trucks For Sale: Your Comprehensive Guide to Affordable Utility pickup.truckstrend.com

In the vast landscape of vehicle acquisition, few avenues offer the potential for significant savings quite like the market for repossessed vehicles. Among these, repo pickup trucks for sale stand out as particularly attractive options for individuals and businesses alike seeking robust utility at a fraction of the cost of new or even conventionally used models. This comprehensive guide will navigate the intricacies of purchasing a repo pickup truck, from understanding what they are to securing the best possible deal.

What Exactly is a Repo Pickup Truck?

Repo Pickup Trucks For Sale: Your Comprehensive Guide to Affordable Utility

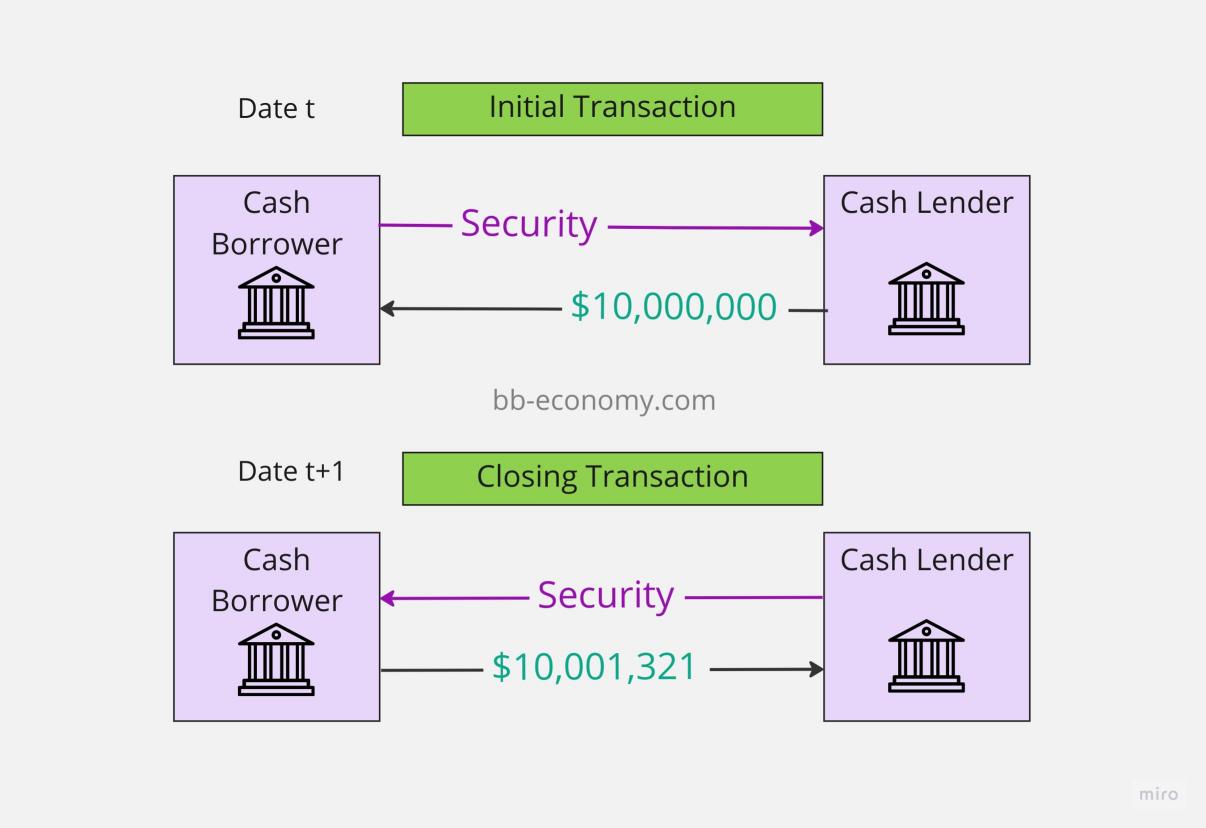

A "repo" or repossessed pickup truck is a vehicle that has been seized by a lender (such as a bank, credit union, or finance company) due to the borrower’s failure to make agreed-upon loan payments. In some cases, a borrower might also voluntarily surrender the vehicle if they can no longer afford the payments. Once repossessed, the lender’s primary goal is to recoup the outstanding balance of the loan. To do this, they typically sell the vehicle, often through auctions, specialized sales, or sometimes directly to the public.

These trucks are not to be confused with salvage vehicles, which have been declared a total loss by an insurance company due to significant damage. Repo trucks are usually in drivable condition, though their maintenance history and current state can vary widely depending on the previous owner’s circumstances. The appeal lies in the fact that lenders are often motivated to sell quickly to minimize their losses, which can translate into competitive pricing for potential buyers.

The Allure of Repossessed Pickups: Why Consider Them?

The decision to pursue a repo pickup truck is often driven by a powerful motivator: value. Here’s why these vehicles capture the attention of budget-conscious buyers:

Significant Cost Savings

This is arguably the most compelling reason. Repo trucks are typically priced below their market value compared to similar models sold through traditional dealerships or private sellers. Lenders are more concerned with recovering loan balances than maximizing profit, which creates opportunities for substantial savings – sometimes thousands of dollars.

Potentially Well-Maintained (But Verify!)

Many repossessed vehicles are relatively new models, as defaults often occur within the first few years of a loan. A truck that is only a few years old might still be in excellent mechanical condition, potentially even with remaining manufacturer warranties (though this should always be verified). Owners struggling financially might defer minor maintenance, but major issues are less common in newer repos unless there was significant prior neglect.

Wide Variety of Makes and Models

The repo market reflects the general vehicle market. You can find a vast array of pickup trucks, from heavy-duty workhorses like Ford F-250s and Ram 3500s to popular half-ton models like the Chevrolet Silverado 1500, Toyota Tundra, and Nissan Titan. Whether you need a truck for towing, hauling, off-roading, or daily commuting, there’s a good chance you’ll find a suitable option.

Quick Transaction Process

Repo sales, especially through auctions, are often streamlined. Once you win a bid or agree on a price, the transaction can be completed relatively quickly, allowing you to drive away in your new truck sooner.

Where to Find Repo Pickup Trucks For Sale

Knowing where to look is crucial for successfully finding a repo pickup truck. The market is diverse, encompassing both online and physical avenues:

1. Bank and Credit Union Websites

Many financial institutions maintain dedicated "repossessed vehicle" sections on their websites. These are often direct sales from the lender, potentially offering more transparency and less competition than an auction setting. Check with local banks and credit unions in your area.

2. Specialized Repossession Auctions

These are perhaps the most common avenues. Companies like Copart, IAAI (Insurance Auto Auctions), and ADESA host large-scale online and physical auctions for repossessed, salvaged, and fleet vehicles.

- Online Auctions: Allow you to bid from anywhere, but often require a broker or dealer license for direct public access. Many have public bidding days or specific public access policies.

- Physical Auctions: Offer the advantage of in-person inspection, though sometimes only limited inspection time is allowed. They can be high-pressure environments.

3. Government Auctions

While less common for standard consumer vehicles, federal, state, and local government agencies occasionally auction off vehicles, including pickups, that were seized or are surplus. Websites like GSA Auctions (for federal vehicles) are a good starting point.

4. Dealerships Specializing in Repos/Used Vehicles

Some independent used car dealerships specialize in acquiring and reselling repossessed vehicles. They often act as intermediaries, taking on the risk and potential repairs, then selling the trucks at a marked-up price. While you might pay more, you often benefit from a cleaned-up vehicle and potentially some level of limited warranty or inspection report.

5. Online Marketplaces (with caution)

Websites like Craigslist, Facebook Marketplace, and even general used car sites (Autotrader, Cars.com) sometimes feature vehicles described as "repo" by private sellers or small-time dealers. Exercise extreme caution here; always demand a clear title and conduct thorough checks.

The Buying Process: A Step-by-Step Guide

Purchasing a repo pickup truck requires diligence and a strategic approach. Follow these steps to maximize your chances of a successful and satisfying purchase:

Step 1: Research and Budgeting

Before you start looking, define your needs. What type of pickup? What features are essential? What’s your absolute maximum budget, including potential repairs, taxes, and fees? Research common issues for the makes and models you’re interested in.

Step 2: Locating Potential Trucks

Utilize the sources mentioned above. Create accounts on auction sites, sign up for email alerts from banks, and regularly check dealership inventories. Be patient; the right truck might not appear immediately.

Step 3: Thorough Inspection (Crucial!)

This is the most critical step. Never buy a repo truck sight unseen if you can avoid it.

- Physical Inspection: Look for body damage, rust (especially undercarriage), uneven tire wear, fluid leaks, and signs of accident repair. Check the interior for excessive wear, stains, and odors.

- Test Drive: If possible, take the truck for a thorough test drive. Listen for unusual noises from the engine, transmission, and suspension. Check the brakes, steering, air conditioning, and all electrical components.

- Professional Pre-Purchase Inspection (PPI): This cannot be stressed enough. For a relatively small fee (typically $100-$200), a certified mechanic will perform a comprehensive inspection, identifying any existing mechanical issues, potential future problems, and verifying the vehicle’s overall condition. This investment can save you thousands in unexpected repairs. Many auction houses allow for PPIs by appointment.

Step 4: Vehicle History Report (VIN Check)

Purchase a Vehicle History Report (VHR) from services like CarFax or AutoCheck using the truck’s VIN (Vehicle Identification Number). This report can reveal:

- Accident history

- Previous owners

- Service records

- Odometer discrepancies (rollbacks)

- Flood or fire damage

- Recall information

- Lien status (ensure the lender has a clear title to sell)

Step 5: Understand "As-Is" Sales

The vast majority of repo trucks are sold "as-is, where-is," meaning there is no warranty, express or implied, from the seller. You are buying the truck in its current condition, with all its faults (known or unknown). This underscores the importance of a PPI.

Step 6: Bidding or Negotiating

- Auctions: Set a maximum bid beforehand and stick to it. Don’t get caught up in the excitement and overpay. Factor in buyer’s premiums, auction fees, and transportation costs.

- Direct Sales: Negotiate respectfully but firmly. Be prepared to walk away if the price isn’t right or if you’re uncomfortable with the truck’s condition.

Step 7: Financing and Paperwork

Secure financing before you bid or make an offer, especially for auctions where immediate payment is often required. Ensure you receive a clear title, bill of sale, and any other necessary documentation for registration in your state.

Important Considerations and Potential Challenges

While the savings are attractive, buying a repo truck isn’t without its potential pitfalls:

- "As-Is" Sales: As mentioned, this is the biggest risk. You assume all responsibility for post-purchase repairs.

- Unknown Maintenance History: Unless records are explicitly provided (which is rare), you’ll be largely in the dark about how well the previous owner maintained the vehicle.

- Potential for Neglect/Abuse: Owners facing financial distress might have deferred critical maintenance, or in some cases, intentionally damaged the vehicle out of spite.

- Cosmetic Imperfections: Minor dents, scratches, or interior wear are common. Sometimes, damage can occur during the repossession process itself.

- Limited Inspection Opportunities: At some high-volume auctions, you might only get a few minutes to inspect a vehicle, or it might be a "blind" bid based solely on photos and a basic description.

- Hidden Issues: Even with a PPI, some issues might be latent and only surface after purchase.

Tips for a Successful Repo Pickup Purchase

- Set a Firm Budget (and Stick to It): Include funds for the truck, taxes, registration, and a buffer for immediate repairs.

- Be Patient and Persistent: The best deals don’t always appear overnight.

- Do Your Homework: Research specific models, common mechanical issues, and fair market values.

- Always Get a VIN Check and PPI: These are non-negotiable steps for mitigating risk.

- Factor in Potential Repair Costs: Assume you’ll need to spend some money on the truck, even if it passes inspection.

- Don’t Get Caught Up in Auction Fever: Stick to your maximum bid.

- Understand All Fees: Auction fees, buyer’s premiums, and transportation costs can add significantly to the final price.

Estimated Price Ranges for Repo Pickup Trucks (Illustrative Examples)

It’s impossible to provide exact prices for repo pickup trucks due to their highly variable nature based on make, model, year, mileage, condition, location, and auction dynamics. However, the table below offers illustrative price ranges based on general categories to give you an idea of what to expect. These are estimates only and should not be taken as definitive prices.

| Category | Typical Age/Mileage | Common Price Range (USD) | Key Considerations |

|---|---|---|---|

| Older/High Mileage | 8+ years old, 150,000+ miles | $5,000 – $12,000 | Good for work trucks, farm use. Expect significant wear, potential for major repairs. Thorough PPI essential. |

| Mid-Range/Average | 4-8 years old, 75,000-150,000 miles | $12,000 – $25,000 | Good balance of age, mileage, and cost. Often popular models. Likely to need some maintenance. |

| Newer/Low Mileage | 1-4 years old, <75,000 miles | $25,000 – $40,000+ | Significant savings compared to new. May still have remaining manufacturer warranty. Best candidates for PPI. |

| Heavy Duty (Older) | 8+ years old, 200,000+ miles | $10,000 – $20,000 | High utility, but high mileage means more wear. Engine/transmission condition paramount. |

| Heavy Duty (Newer) | 1-7 years old, <150,000 miles | $25,000 – $50,000+ | Excellent value for commercial or serious towing needs. Diesel engines often hold value better. |

| Damaged/Non-Running | Varies | $1,000 – $8,000+ | For mechanics or those with repair capabilities. Requires significant investment post-purchase. Often auction-only. |

Disclaimer: These ranges are highly generalized. Prices are heavily influenced by the specific make and model (e.g., a newer Ford F-150 will be significantly more than an older Nissan Frontier), trim level, condition, regional market demand, and the specific auction or seller.

Frequently Asked Questions (FAQ)

Q1: Are repo trucks stolen vehicles?

A1: No. Repo trucks are legally repossessed by lenders due to loan default. They are sold with clear titles from the financial institution that seized them. Always verify the title’s authenticity and lien status.

Q2: Can I get a warranty on a repo truck?

A2: Generally, no. Most repo trucks are sold "as-is" with no warranty from the seller (bank, auction house). If a truck is relatively new, it might still have a residual manufacturer’s warranty, but this is rare and must be confirmed with the manufacturer using the VIN.

Q3: Is financing available for repo trucks?

A3: Yes, but it can be more challenging than financing a new or certified pre-owned vehicle. Some banks or credit unions might offer loans for repo vehicles, but interest rates might be higher, and stricter lending criteria may apply. It’s best to secure pre-approval before you start bidding.

Q4: How do I know if a repo truck is a good deal?

A4: A good deal combines a low purchase price with minimal immediate repair needs. The best way to determine this is through a comprehensive pre-purchase inspection by a trusted mechanic and a thorough vehicle history report (VIN check). Compare the truck’s condition and price to its fair market value for a non-repo equivalent.

Q5: What’s the difference between a repo and a salvage title?

A5: A repo truck’s title is typically "clean," meaning it hasn’t been declared a total loss by an insurance company. A salvage title indicates that the vehicle has sustained significant damage (e.g., from an accident, flood, or fire) and the cost of repair exceeded a certain percentage of its value. Salvage vehicles are much riskier and often cannot be registered without passing a rigorous inspection.

Q6: Do repo trucks always come with keys?

A6: Most repo trucks sold through reputable auctions or lenders will come with at least one set of keys. However, it’s not guaranteed, and you should always confirm this before bidding or buying. Replacing lost keys, especially for modern vehicles with transponders, can be expensive.

Concluding Summary

Purchasing a repo pickup truck for sale presents a compelling opportunity to acquire a valuable asset at a significantly reduced cost. While the allure of substantial savings is strong, success in this market hinges on diligent research, thorough inspection, and a clear understanding of the "as-is" nature of these transactions. By following the practical advice outlined in this guide – prioritizing pre-purchase inspections, vehicle history reports, and a disciplined approach to budgeting – you can navigate the repo market confidently and drive away with a robust pickup truck that serves your needs without breaking the bank. It’s a journey that demands patience and prudence, but for the informed buyer, the rewards can be truly substantial.