Progressive Food Truck Insurance: Your Comprehensive Guide to Protecting Your Mobile Culinary Dream pickup.truckstrend.com

The aroma of sizzling gourmet burgers, the vibrant colors of exotic tacos, or the comforting steam from a bowl of artisanal soup – food trucks have revolutionized the culinary landscape, bringing diverse and delicious experiences directly to the people. More than just mobile kitchens, these entrepreneurial ventures are complex businesses on wheels, facing a unique blend of risks that traditional restaurants or retail stores don’t. From traffic accidents to foodborne illnesses, equipment breakdowns to unexpected theft, the potential pitfalls are as varied as the menus they offer.

This is where specialized insurance becomes not just an option, but an absolute necessity. Among the leading providers offering robust protection for the mobile food industry is Progressive. With a long-standing reputation for understanding the intricacies of commercial vehicles and businesses, Progressive offers tailored food truck insurance solutions designed to safeguard your investment, your livelihood, and your peace of mind. This comprehensive guide will delve into the world of Progressive Food Truck Insurance, exploring its importance, what it covers, how to secure it, and why it’s a smart choice for any aspiring or established food truck owner.

Progressive Food Truck Insurance: Your Comprehensive Guide to Protecting Your Mobile Culinary Dream

Understanding the Unique Risks of Food Trucks

Before diving into the specifics of Progressive’s offerings, it’s crucial to grasp why food trucks require a distinct insurance approach. Their mobile nature and operational setup introduce a multitude of specific exposures:

- Road Hazards: As commercial vehicles, food trucks are constantly exposed to the risks of traffic accidents, collisions, and theft while in transit or parked.

- Operational Equipment: These trucks are packed with specialized, high-value cooking equipment – grills, fryers, refrigerators, generators – all of which are susceptible to fire, mechanical breakdown, or theft.

- Customer Interaction: Serving food directly to the public opens up risks of slip-and-fall accidents, property damage caused by customers, or even claims of foodborne illness or allergic reactions.

- Inventory and Supplies: Perishable food, valuable ingredients, and disposable supplies are constantly on board, vulnerable to spoilage, theft, or damage.

- Vandalism and Theft: Being mobile and often parked in public places makes food trucks potential targets for vandalism, break-ins, or even the theft of the entire vehicle.

- Business Interruption: A major accident, fire, or equipment failure can force a food truck to shut down, leading to significant loss of income and ongoing expenses.

Traditional personal auto policies or standard business insurance simply don’t adequately address this unique combination of risks. Specialized coverage is paramount.

Why Choose Progressive for Your Food Truck Insurance?

Progressive stands out as a leading choice for food truck insurance for several compelling reasons, rooted in their extensive experience and tailored approach:

- Commercial Auto Expertise: Progressive has long been a frontrunner in commercial auto insurance, understanding the complexities of vehicles used for business purposes. This deep expertise translates directly to comprehensive coverage for your food truck as a vehicle.

- Tailored Solutions: Recognizing that no two food trucks are identical, Progressive offers customizable policies. They don’t just sell you a generic package; they work to understand your specific operations, vehicle type, and risk profile to build a policy that fits.

- Financial Stability and Reputation: As one of the largest insurance providers in the U.S., Progressive boasts significant financial strength, ensuring they can pay out claims reliably. Their strong reputation for customer service and efficient claims processing provides peace of mind.

- Bundling Opportunities: Progressive often provides opportunities to bundle different types of commercial insurance – like commercial auto and general liability – which can lead to significant discounts and streamline your policy management.

- Accessibility and Convenience: With a robust online platform and a network of knowledgeable agents, getting a quote, managing your policy, and filing a claim is designed to be as straightforward as possible.

- Specific Food Industry Understanding: While they cover a wide range of commercial vehicles, Progressive has developed a strong understanding of the food service industry, allowing them to offer relevant coverages like food spoilage or contamination.

Key Coverage Types Offered by Progressive for Food Trucks

A comprehensive Progressive food truck insurance policy typically combines several essential coverage types to provide holistic protection. Here are the primary components:

-

Commercial Auto Liability: This is foundational. It covers damages and injuries you cause to other people or their property while operating your food truck.

- Bodily Injury Liability: Pays for medical expenses, lost wages, and pain and suffering for others if you’re at fault in an accident.

- Property Damage Liability: Covers repairs or replacement of property belonging to others that your truck damages.

- Why it’s crucial: Accidents happen, and liability costs can be astronomical without proper coverage.

-

Physical Damage Coverage (for your Truck): Protects your food truck itself from various perils.

- Collision Coverage: Pays for repairs or replacement of your truck if it’s damaged in a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Protects your truck from non-collision incidents like theft, vandalism, fire, falling objects, natural disasters, or hitting an animal.

- Why it’s crucial: Your truck is your primary asset. Replacing or repairing it can be incredibly expensive.

-

General Liability Insurance: This is distinct from commercial auto liability and covers non-auto related risks your business faces.

- Premises Liability: Covers slip-and-fall accidents, injuries, or property damage that occur at your food truck’s location (e.g., a customer trips over a power cord).

- Product Liability: Crucial for food businesses, this covers claims of illness or injury caused by the food or beverages you serve (e.g., food poisoning, allergic reactions).

- Advertising Injury: Covers claims of slander, libel, or copyright infringement arising from your advertising.

- Why it’s crucial: Protects against the common risks of operating a business that interacts with the public and serves consumables.

-

Business Personal Property (BPP) / Inland Marine Coverage:

- Business Personal Property: Covers your cooking equipment, inventory, utensils, cash registers, and other movable property inside your food truck if damaged or stolen.

- Inland Marine: Specifically designed for property that is frequently transported. This can be vital if you often remove equipment from your truck for cleaning, storage, or transport to catering events.

- Why it’s crucial: Your specialized equipment is a significant investment. This covers it beyond just the truck’s structure.

-

Workers’ Compensation: If you have employees, this is often legally required. It covers medical expenses and lost wages for employees injured on the job, regardless of fault. Progressive can help you secure this coverage.

-

Business Interruption / Loss of Income: If a covered peril (like a fire or major accident) forces your food truck to shut down temporarily, this coverage helps replace lost income and cover ongoing expenses (rent, loan payments, salaries) during the repair period.

-

Food Spoilage/Contamination Coverage: A specialized endorsement that covers losses due to food spoilage resulting from equipment breakdown, power outage, or contamination.

How to Get a Progressive Food Truck Insurance Quote

Securing a Progressive food truck insurance quote is a straightforward process, designed to gather the necessary information to tailor a policy to your specific needs:

-

Gather Your Information: Before you start, have the following details ready:

- Vehicle Information: Year, make, model, VIN, estimated annual mileage, and gross vehicle weight of your food truck.

- Business Operations: Type of cuisine, typical operating locations (street, events, private catering), hours of operation, and whether you operate seasonally or year-round.

- Equipment Details: List of major cooking equipment, their value, and whether they are permanently installed or removable.

- Driver Information: Details for all drivers (driving records, experience).

- Employee Information: Number of employees, payroll estimates (for Workers’ Comp).

- Desired Coverage Limits: Consider how much coverage you think you’ll need for each type of insurance.

- Prior Insurance History: Any previous commercial insurance policies and claims history.

-

Choose Your Method:

- Online Quote: Progressive’s website offers an intuitive online quoting tool where you can input your information and get initial estimates quickly.

- Phone Call: Speak directly with a Progressive commercial insurance specialist who can guide you through the process, answer questions, and help you customize your policy.

- Independent Agent: Many independent insurance agents partner with Progressive. They can help you compare Progressive’s offerings with other carriers and find the best fit.

-

Review and Customize: Once you receive a quote, review the coverage limits, deductibles, and premiums carefully. Don’t hesitate to ask questions or request adjustments to ensure the policy aligns perfectly with your risk tolerance and budget.

Important Considerations & Tips for Food Truck Owners

Navigating the world of food truck insurance can seem complex, but these tips will help you make informed decisions:

- Assess Your Specific Risks Thoroughly: A deep fryer business has different risks than a smoothie truck. Consider your menu, cooking methods, locations, and customer base when determining your coverage needs.

- Don’t Underinsure: While saving money is tempting, skimping on coverage can leave you financially devastated after a major incident. The cost of a claim often far outweighs the premium savings.

- Understand Your Deductibles: A higher deductible typically means lower premiums, but ensure you can comfortably afford to pay it out-of-pocket if a claim arises.

- Read the Fine Print (Exclusions): Always understand what your policy doesn’t cover. For example, some policies might exclude certain types of equipment breakdown or specific natural disasters.

- Implement Safety Measures: Proactive risk management can reduce your chances of a claim and potentially lower your premiums. This includes regular vehicle maintenance, proper training for staff, adherence to food safety regulations, and clear signage for customers.

- Regularly Review Your Policy: As your business grows, changes locations, adds equipment, or hires more staff, your insurance needs will evolve. Review your policy annually with your agent to ensure it remains adequate.

- Leverage Bundling Discounts: Ask Progressive about combining commercial auto with general liability or other policies for potential savings.

- Commercial vs. Personal: Never use a personal auto policy for your food truck. It will not cover business-related incidents, leaving you completely exposed.

Navigating Challenges and Solutions

Even with a reliable provider like Progressive, challenges can arise. Being prepared is key:

- Challenge: High Premiums: Food truck insurance can be costly due to the inherent risks.

- Solution: Increase your deductibles (if comfortable), implement robust safety protocols, maintain a clean driving record, and ask about available discounts (e.g., bundling, paid-in-full, multi-policy).

- Challenge: Understanding Complex Terms: Insurance policies are often filled with jargon.

- Solution: Don’t hesitate to ask your Progressive agent to explain anything you don’t understand. Take notes and ensure clarity before signing.

- Challenge: Filing a Claim: The process can feel overwhelming during a stressful time.

- Solution: Progressive aims for a streamlined claims process. Report incidents promptly, gather all necessary documentation (photos, police reports, witness statements), and communicate openly with your claims adjuster.

Progressive Food Truck Insurance: Sample Pricing Guide

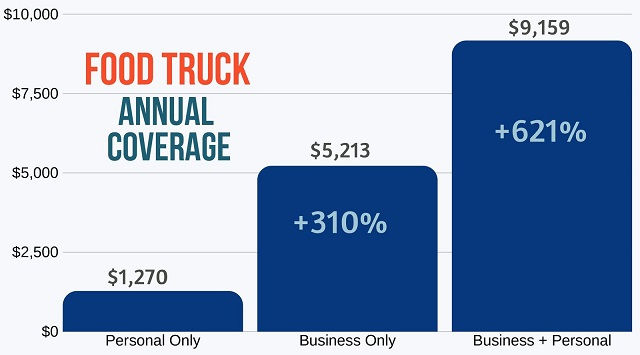

It’s crucial to understand that actual insurance premiums vary significantly based on a multitude of factors unique to each food truck business. These include the truck’s value, make, model, age, location of operation, driving records of operators, types and limits of coverage chosen, claims history, and even the type of food served.

The table below provides illustrative price ranges for various components of Progressive Food Truck Insurance. These are not actual quotes but rather general estimates to help you understand potential costs. Always obtain a personalized quote directly from Progressive or an authorized agent for accurate pricing.

| Coverage Type | Typical Annual Price Range (Illustrative) | Key Factors Influencing Cost