Repo Tow Trucks For Sale Near Me: Unlocking Value in the Towing Industry pickup.truckstrend.com

The world of commercial vehicle acquisition can be daunting, especially when looking for specialized equipment like tow trucks. New tow trucks represent a significant capital investment, often placing them out of reach for budding entrepreneurs or smaller operations. This is where the market for "Repo Tow Trucks For Sale Near Me" steps in, offering a compelling alternative. A repo tow truck, short for a repossessed tow truck, is a vehicle that has been seized by a lender (such as a bank or credit union) due to the borrower’s default on their loan payments. These assets are then sold to recoup the outstanding debt, often at prices significantly below market value.

This guide will delve into every facet of purchasing a repo tow truck, from understanding what they are and where to find them, to the critical considerations and steps involved in making an informed purchase. Whether you’re looking to start a new towing business, expand your existing fleet, or simply find a reliable workhorse without breaking the bank, understanding the repo market is your first step towards unlocking substantial value.

Repo Tow Trucks For Sale Near Me: Unlocking Value in the Towing Industry

What Exactly Are Repo Tow Trucks?

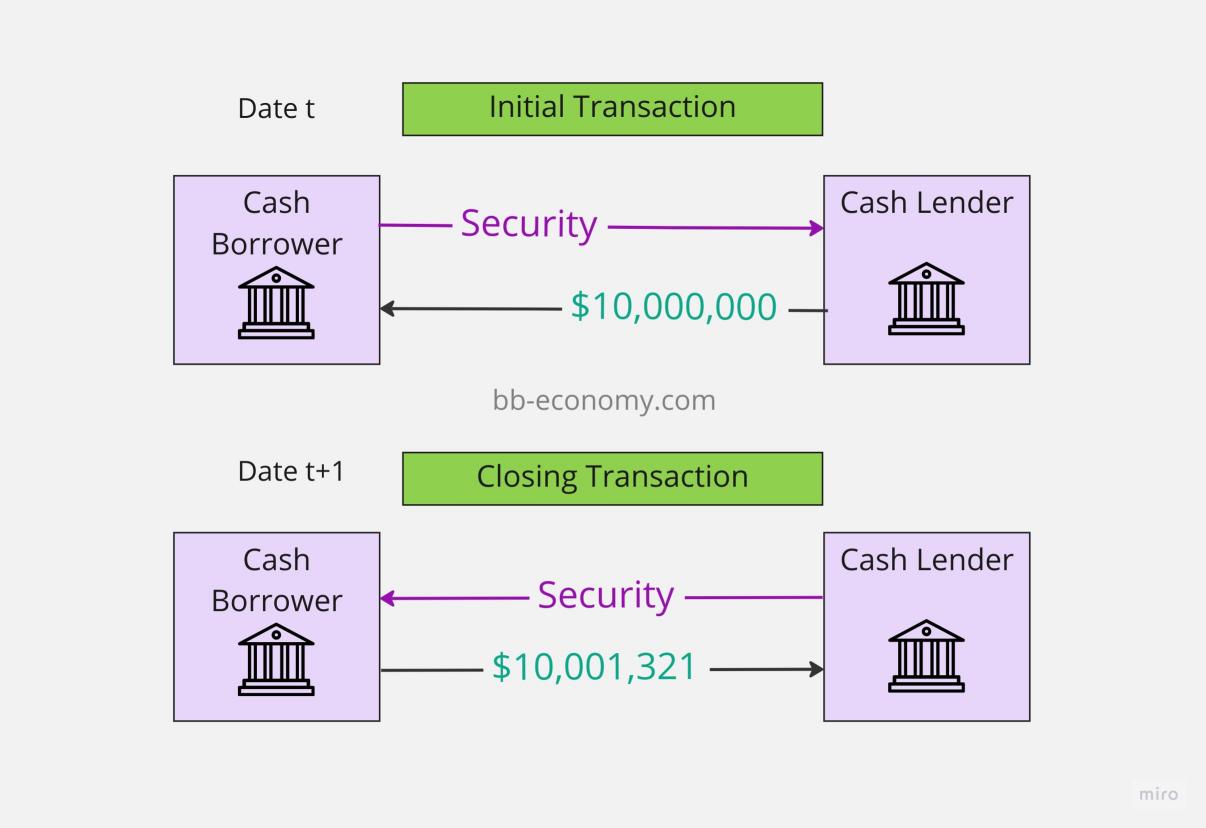

At its core, a repo tow truck is a piece of collateral that has reverted to the ownership of a lender. When an individual or business fails to meet their financial obligations on a loan secured by the tow truck, the lender exercises its right to repossess the asset. Once repossessed, the lender’s primary goal is to liquidate the asset quickly and efficiently to minimize their loss. This urgency often translates into competitive pricing for buyers.

Who sells these repossessed vehicles?

- Banks and Credit Unions: These are the primary sources, as they are the direct lenders. Many financial institutions have dedicated "repo" or "asset liquidation" sections on their websites or work with specific auction houses.

- Government Agencies: Occasionally, government bodies like the Small Business Administration (SBA) or IRS may seize and auction vehicles, including tow trucks, from defaulted loans or tax evasion cases.

- Auction Houses: Specialized commercial vehicle auctioneers, or even general public auction sites, often handle the sale of repossessed assets on behalf of lenders.

- Repo Agents/Brokers: Some businesses specialize in facilitating the sale of repossessed vehicles, acting as intermediaries between lenders and potential buyers.

The unique aspect of the repo market is its "distressed asset" nature. While the trucks themselves might be in varying conditions, the motivation behind their sale is financial recovery, not profit maximization from the vehicle’s inherent value. This often leads to opportunities for buyers to acquire essential equipment at a fraction of the cost of new or even traditionally used models.

The Allure of Repo Tow Trucks: Benefits and Advantages

The decision to consider a repo tow truck is often driven by several attractive benefits:

- Significant Cost Savings: This is undoubtedly the most compelling advantage. Repo tow trucks are frequently sold at prices considerably lower than their retail or even typical used market value. This can free up significant capital for other business needs, such as marketing, insurance, or initial operating costs.

- Immediate Availability: Unlike ordering a new tow truck, which can involve long lead times for manufacturing and customization, repo trucks are typically available for immediate purchase and pickup. This means you can get your new asset working for you much faster, accelerating your return on investment.

- Variety and Selection: The repo market offers a diverse range of tow trucks. You might find light-duty wheel-lifts perfect for roadside assistance, versatile flatbeds for accident recovery and transport, or even heavy-duty wreckers for commercial vehicle towing. This variety allows buyers to find a truck that precisely matches their specific operational needs and budget.

- Lower Depreciation: Since you’re buying at a depreciated price point, your initial depreciation hit is much smaller compared to buying new. This can be a significant financial advantage over the long term.

- Potential for Quick ROI: A lower initial investment means that your tow truck can start generating revenue and recouping its cost much faster. For new businesses, this can be the difference between struggling and thriving.

Where to Find Repo Tow Trucks For Sale Near Me: Your Search Strategy

Finding a repo tow truck requires a targeted approach. The "near me" aspect is crucial, as transportation costs for heavy equipment can be substantial.

-

Online Auction Platforms:

- Government Auctions: Websites like GovDeals.com, GSAAuctions.gov, or state/local government surplus sites sometimes list repossessed or surplus commercial vehicles.

- Bank/Credit Union Specific Sites: Many larger financial institutions have dedicated sections on their corporate websites listing repossessed assets. Searching "repossessed vehicles [bank name]" can yield results.

- General Auction Sites with Commercial Sections: Platforms like Copart.com and IAAI.com (often known for salvage, but also list repossessions), and Ritchie Bros. Auctioneers, IronPlanet, or Proxibid (for heavy equipment) are excellent resources. Use specific filters for "tow trucks" and "repossessed."

- Specialized Equipment Auctioneers: Companies that focus solely on commercial trucks and heavy equipment are often the best bet.

-

Local Bank & Credit Union Branches: Don’t underestimate the power of direct inquiry. Visit or call local branches of banks and credit unions. While they might direct you to an online portal, sometimes local managers are aware of upcoming repos.

-

Used Commercial Vehicle Dealerships: Some dealerships specialize in used commercial trucks and equipment. They may acquire repo trucks themselves and then recondition and resell them. While potentially more expensive than direct auction, they might offer financing or warranties.

-

Online Classifieds & Marketplaces: Websites like Craigslist (use caution and verify everything), Facebook Marketplace, or specialized commercial vehicle classifieds can occasionally feature repo trucks directly from smaller lenders or individuals. Always prioritize safety and verify legitimacy.

-

Networking: Talk to local towing companies, mechanics, and equipment transporters. They often have insights into local sales or know who to contact.

Tips for "Near Me" Search: When using online platforms, leverage their location filters extensively. For general search engines, combine your keywords with your city, county, or state, e.g., "tow truck repo Dallas TX" or "repossessed flatbed for sale Georgia."

Essential Considerations Before Buying a Repo Tow Truck

While the savings are attractive, buying a repo tow truck is not without its risks. Thorough due diligence is paramount.

-

Condition is King (and often unknown): Repo trucks are almost always sold "as-is, where-is" with no warranties. This means you are buying it in its current condition, flaws and all.

- Pre-Purchase Inspection (PPI): This is non-negotiable. Hire a qualified, independent mechanic specializing in heavy trucks to inspect the vehicle thoroughly. They should check the engine, transmission, hydraulics (winch, boom, wheel lift, flatbed mechanics), frame, suspension, tires, brakes, and electrical system. Don’t rely solely on photos or descriptions.

- Hidden Damage: Repos often have dings, dents, or more significant damage that wasn’t worth fixing for the previous owner. Factor in potential bodywork or cosmetic repairs.

-

Hidden Costs: The purchase price is just one component.

- Repair and Maintenance: Budget a significant amount (e.g., 10-30% of the purchase price) for immediate repairs, deferred maintenance, and reconditioning to get the truck road-ready and reliable.

- Auction Fees/Buyer’s Premium: Online auctions typically charge a percentage of the final bid as a buyer’s premium.

- Transportation: If the truck isn’t truly "near me," factor in the cost of transporting it to your location.

- Title and Registration: Account for state-specific title transfer fees, sales tax, and registration costs.

-

Mileage and Hours: Pay close attention to both the odometer reading and engine hours (if available). High mileage or hours can indicate significant wear, but a well-maintained high-mileage truck might be better than a poorly maintained low-mileage one.

-

Documentation: Ensure a clear title is available and can be transferred easily. Service records are rarely available with repos, but if they are, consider it a bonus.

-

Type of Tow Truck for Your Needs:

- Wheel-Lift (Self-Loader): Ideal for light to medium-duty towing, often preferred for quick repositions and roadside assistance.

- Flatbed (Rollback): Versatile for transporting damaged vehicles, luxury cars, or equipment that cannot be towed conventionally.

- Integrated/Wrecker (Boom Truck): Heavy-duty options for commercial trucks, buses, and complex recovery operations. Ensure the boom and winch capacities match your intended use.

-

Financing: Traditional vehicle loans can be harder to secure for "as-is" repo vehicles. Be prepared for cash purchase or explore specialized equipment financing options from lenders familiar with the repo market.

The Buying Process: A Step-by-Step Guide

Navigating the repo market successfully involves a structured approach:

-

Define Your Needs and Budget: Before you even start looking, determine precisely what type of tow truck you need (capacity, type) and your absolute maximum budget, including potential repair costs.

-

Research and Locate: Utilize the search strategies outlined above. Cast a wide net initially, then narrow down based on location and specific truck type.

-

Thorough Inspection (Critical Step): Once you’ve identified a potential candidate, arrange for a pre-purchase inspection by a trusted, independent mechanic. If the truck is at an auction, check their inspection policies and access times. Document everything with photos and notes.

-

Review Terms and Conditions: Read all the fine print, especially for auctions. Understand the payment terms, buyer’s premium, pickup deadlines, and "as-is" clauses.

-

Bidding or Negotiating Strategy:

- Auctions: Set a maximum bid based on your budget and the mechanic’s assessment of potential repairs. Stick to it. Don’t get caught up in bidding wars.

- Direct Sales: If buying from a bank or dealer, be prepared to negotiate, but understand they are often looking for a quick sale.

-

Payment and Pickup: Once you’ve won or agreed on a price, arrange for prompt payment. Be aware of strict pickup deadlines at auction sites; late fees can accrue quickly. Arrange for transport if needed.

-

Post-Purchase Checklist:

- Title Transfer: Immediately transfer the title into your name.

- Insurance: Secure proper commercial vehicle insurance before putting the truck into service.

- Initial Maintenance: Schedule a full fluid change, filter replacements, and address any immediate repair recommendations from your pre-purchase inspection.

Types of Repo Tow Trucks You Might Find

The repo market mirrors the general tow truck market in terms of variety. Understanding the types will help you narrow your search:

- Wheel-Lift Tow Trucks (Self-Loaders): These are common and often the most affordable repo options. They lift the vehicle by its wheels, suitable for light to medium-duty passenger vehicles. Great for roadside assistance and light recovery.

- Flatbed Tow Trucks (Rollbacks): Highly versatile, these trucks have a hydraulically operated bed that tilts and slides back to load vehicles. Ideal for transporting damaged cars, luxury vehicles, motorcycles, or even small equipment. You’ll find light, medium, and sometimes even heavy-duty flatbeds.

- Integrated Tow Trucks (Wreckers/Boom Trucks): These are heavier-duty trucks equipped with a boom, winch, and often a wheel-lift attachment. They are designed for more complex recovery scenarios, including uprighting overturned vehicles or pulling vehicles out of ditches. These can range from medium-duty (for larger SUVs, light commercial) to heavy-duty (for semi-trucks, buses).

- Heavy-Duty Wreckers: The largest and most specialized tow trucks, designed to handle the heaviest commercial vehicles. Even as repos, these remain significant investments, but can still offer substantial savings over new.

Your choice should align directly with the types of jobs you intend to perform. A light-duty wheel-lift won’t cut it for semi-truck recovery, just as a heavy-duty wrecker might be overkill and inefficient for everyday roadside assistance.

Potential Challenges and Solutions

Buying a repo tow truck isn’t without its potential pitfalls, but most can be mitigated with proper planning:

- Challenge: Unknown Service History.

- Solution: Assume the worst and budget for comprehensive maintenance immediately. A thorough pre-purchase inspection is your best defense.

- Challenge: Immediate Repairs Needed.

- Solution: Always factor in a repair contingency fund. Don’t deplete your budget on the purchase price alone.

- Challenge: Competitive Bidding.

- Solution: Stick to your pre-determined maximum budget. Emotional bidding can lead to overpaying. There will always be another repo.

- Challenge: "As-Is" Sale with No Warranty.

- Solution: Accept this reality. Your due diligence (inspection, budgeting for repairs) is your only "warranty."

- Challenge: Limited Options "Near Me."

- Solution: Expand your search radius, but carefully calculate transportation costs. Sometimes a slightly more expensive truck further away, in better condition, is a better overall deal.

Price Table: Estimated Repo Tow Truck Price Ranges

It’s crucial to understand that actual repo prices fluctuate wildly based on make, model, year, condition, mileage, location, and demand. The table below provides estimated ranges and highlights key factors, not definitive prices.

| Type of Tow Truck | Typical New Price Range (USD) | Typical Used Price Range (USD) | Estimated Repo Price Range (USD)* | Key Factors Affecting Repo Price