Lease To Own Semi Trucks For Sale: Your Highway to Ownership pickup.truckstrend.com

The dream of owning your own semi-truck and running your independent trucking business is a powerful one. However, the hefty upfront cost of purchasing a new or even used rig can be a significant barrier. This is where Lease To Own Semi Trucks For Sale enters the picture as a crucial, flexible pathway for aspiring owner-operators and established businesses looking to expand their fleet without crippling capital expenditure.

A lease-to-own agreement, also known as a lease-purchase or rent-to-own, offers a unique blend of leasing and purchasing. It allows you to operate a semi-truck by making regular lease payments, with the ultimate option to buy the truck at the end of the lease term. This structure provides a valuable alternative to traditional financing, making truck ownership more accessible and manageable. For many, it’s not just about acquiring a vehicle; it’s about building equity, establishing a business, and charting a course towards financial independence in the competitive world of trucking. This comprehensive guide will delve into every facet of lease-to-own semi trucks, offering insights, practical advice, and a clear roadmap for your journey to ownership.

Lease To Own Semi Trucks For Sale: Your Highway to Ownership

Understanding the Lease-to-Own Model

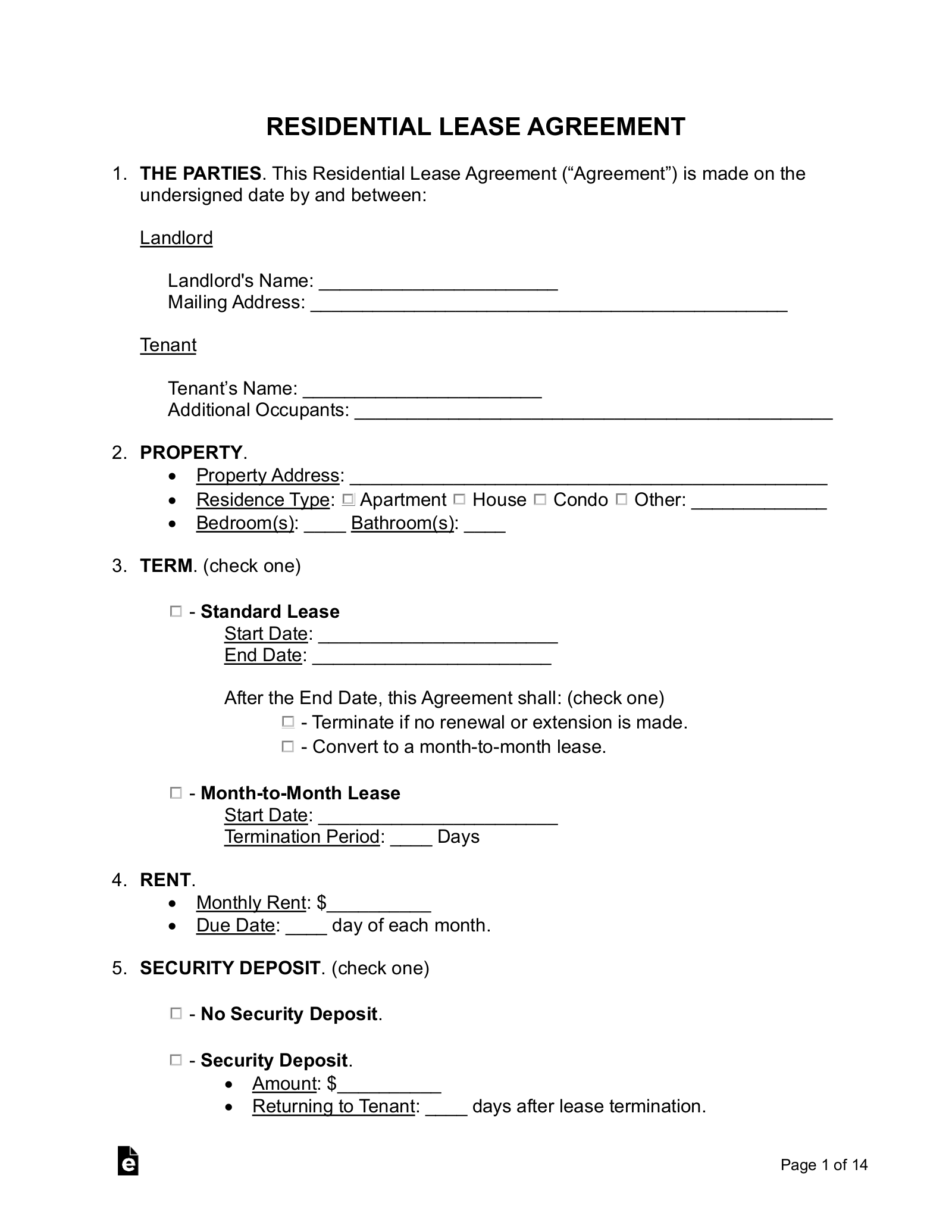

At its core, a lease-to-own agreement for a semi-truck is a contract where you, the lessee, pay a series of monthly payments to the lessor (the truck owner or financing company) for the right to use the truck. Unlike a standard lease where you simply return the truck at the end of the term, a lease-to-own agreement includes an option, or sometimes an obligation, to purchase the truck for a predetermined price, often referred to as the "residual value" or "buyout price," at the end of the lease period.

During the lease term, you are typically responsible for the truck’s operation, maintenance, and insurance, much like an owner. A portion of your monthly payment might even go towards building equity in the truck, reducing the final buyout price. This model is particularly appealing because it bridges the gap between renting and buying, offering the flexibility of a lease with the long-term benefit of ownership.

Why Consider Lease-to-Own? Benefits for Owner-Operators

The appeal of lease-to-own extends beyond just getting behind the wheel. It offers several distinct advantages that can be game-changers for individuals and small businesses in the trucking industry:

- Lower Upfront Costs: Traditional truck purchases often require substantial down payments, sometimes 15-30% of the truck’s value. Lease-to-own agreements typically demand much lower, or even no, down payments, freeing up capital for other business necessities like insurance, permits, and initial operating expenses.

- Path to Ownership: For those with limited credit history or lower credit scores, lease-to-own can serve as a stepping stone. Consistent, on-time payments demonstrate financial responsibility, which can improve your credit profile, making traditional financing more accessible in the future.

- Credit Flexibility: Many lease-to-own programs are more lenient with credit requirements than conventional bank loans. Lessors understand the unique financial challenges of the trucking industry and may be willing to work with applicants who don’t meet strict bank criteria.

- Potential Tax Advantages: Depending on the structure of the lease and your specific tax situation, lease payments may be deductible business expenses. It’s crucial to consult with a tax professional to understand the implications for your business.

- Maintenance Support (Variable): Some lease-to-own programs, particularly those offered by carriers or larger dealerships, might include maintenance packages or offer discounted services during the lease term. This can significantly reduce unexpected repair costs and provide peace of mind.

- Test Drive Ownership: It allows you to "try out" truck ownership without the full financial commitment upfront. You can assess your ability to manage the responsibilities of a truck owner, including maintenance, dispatching, and financial management, before fully committing.

The Lease-to-Own Process: A Step-by-Step Guide

Navigating the lease-to-own landscape requires a clear understanding of the process. Here’s a typical step-by-step guide:

- Research and Find Programs: Start by researching dealerships, independent leasing companies, and even trucking carriers that offer lease-to-own programs. Compare their offerings, truck availability, and general terms.

- Application and Qualification: Submit an application, which will typically include your personal and business financial information, driving record, and trucking experience. The lessor will assess your creditworthiness and ability to make payments.

- Understand the Terms: This is the most critical step. Scrutinize the contract for:

- Down Payment: The initial amount required.

- Monthly Payments: The fixed payment amount for the lease term.

- Lease Term: The duration of the lease (e.g., 24, 36, 48 months).

- Residual Value/Buyout Price: The amount you’ll need to pay to own the truck at the end of the lease.

- Mileage Limits: Some leases impose mileage restrictions, with penalties for exceeding them.

- Maintenance Responsibilities: Clearly define who is responsible for routine maintenance and major repairs.

- Early Termination Clauses: What happens if you need to end the lease early?

- Vehicle Selection and Inspection: Once approved, select the semi-truck that fits your needs. Crucially, have an independent, qualified mechanic thoroughly inspect the truck. This is vital to avoid inheriting costly problems.

- Sign the Agreement: After understanding and agreeing to all terms, sign the lease-to-own contract. Ensure you have a copy for your records.

- Operate the Truck and Make Payments: Begin operating your truck, making all monthly payments on time. Adhere to all terms, including maintenance schedules and mileage limits.

- Exercising the Purchase Option: As the lease term nears its end, you’ll have the option to purchase the truck by paying the agreed-upon residual value. If you choose not to, you typically return the truck, though some agreements may have other provisions.

Key Considerations Before Committing

While attractive, lease-to-own isn’t without its complexities. Thorough due diligence is paramount:

- Total Cost vs. Traditional Financing: Lease-to-own often results in a higher overall cost for the truck compared to a direct purchase with a traditional loan, due to higher effective interest rates or administrative fees built into the payments. Calculate the total cost (down payment + all monthly payments + buyout price) and compare it.

- Lease Terms and Hidden Fees: Read every line of the contract. Look for administrative fees, late payment penalties, early termination fees, and specific clauses regarding wear and tear or mileage overages.

- Maintenance Responsibilities: Understand who pays for what. Is preventative maintenance covered? What about major engine or transmission failures? An unexpected repair bill can quickly derail your budget.

- Insurance Requirements: Lessors will require you to carry comprehensive insurance coverage. Factor these costs into your operating budget.

- Credit Score Impact: While LTO can help build credit, missing payments will severely damage it.

- Vehicle Condition and Warranty: For used trucks, ensure you understand the truck’s history and any remaining warranty. An independent inspection is non-negotiable.

- Exit Strategies: What happens if the trucking market slows down, your business struggles, or you simply decide trucking isn’t for you? Understand the terms for returning the truck or transferring the lease.

Types of Lease-to-Own Programs

Lease-to-own opportunities come from various sources, each with its own nuances:

- Dealer-Offered Programs: Many large semi-truck dealerships offer their own in-house lease-to-own programs, often for new or certified used trucks. These can be convenient, but terms may be less flexible.

- Third-Party Leasing Companies: Independent financial institutions specialize in equipment leasing, including semi-trucks. They may offer a wider range of truck types and more customized terms.

- Carrier-Backed Programs (Company-Sponsored): Some trucking companies offer lease-to-own programs to their drivers. These often come with guaranteed freight and sometimes maintenance support, but they may also have strict operational requirements or non-compete clauses. They are often structured to keep drivers with the company.

Tips for Success in a Lease-to-Own Arrangement

To maximize your chances of success and transition smoothly to truck ownership:

- Do Your Due Diligence: Research the lessor’s reputation, read reviews, and talk to other drivers who have used their programs.

- Negotiate Terms: Don’t be afraid to negotiate the down payment, monthly payment, buyout price, or even mileage limits. Every dollar saved adds up.

- Maintain the Truck Diligently: Treat the truck as if it’s already yours. Follow all preventative maintenance schedules, keep detailed records, and address minor issues before they become major problems. This protects your investment and ensures reliability.

- Manage Finances Carefully: Create a robust business plan and budget. Factor in all operating costs, including fuel, insurance, maintenance, tolls, and your lease payments. Maintain an emergency fund for unexpected repairs or slow periods.

- Build a Good Relationship: Maintain open communication with your lessor. If you anticipate a late payment or have a question, reach out promptly.

- Have an Emergency Fund: Trucking is unpredictable. A breakdown or a slow freight period can quickly deplete cash flow. An emergency fund is your safety net.

Potential Challenges and Solutions

Despite its benefits, lease-to-own can present challenges:

- High Interest/Total Cost:

- Challenge: The total cost can be significantly higher than traditional financing.

- Solution: Thoroughly calculate the total cost upfront. Compare multiple offers. Consider it an investment in building your credit and business.

- Strict Mileage Limits:

- Challenge: Exceeding limits can incur hefty per-mile penalties.

- Solution: Negotiate higher limits if your business plan requires it. Carefully track your mileage and adjust routes if necessary.

- Maintenance Disputes:

- Challenge: Disagreements over who is responsible for certain repairs can arise.

- Solution: Ensure the maintenance clause in your contract is crystal clear. Document all maintenance performed and keep receipts. Get repairs done by certified mechanics.

- Difficulty Exiting the Agreement:

- Challenge: Early termination fees or strict return conditions can make it hard to exit.

- Solution: Understand the early termination clause before signing. Explore options like lease transfers if available.

Illustrative Lease-to-Own Cost Breakdown

It’s crucial to understand that specific lease-to-own prices for semi-trucks vary widely based on numerous factors: the truck’s make, model, year, mileage, condition, the specific lessor, the applicant’s creditworthiness, and the negotiated terms (down payment, lease term, residual value). Therefore, a definitive "price table" with fixed numbers is misleading.

Instead, here is an illustrative range and structure to help you understand the potential financial components you would typically see in a lease-to-own agreement. These figures are estimates only and serve as an example for comparison, not a quote.

| Component | Illustrative Range (Used Semi-Truck) | Notes |

|---|---|---|

| Truck Value | $40,000 – $120,000 (depending on age, condition, make/model) | This is the starting value of the truck. Newer or low-mileage trucks will be at the higher end. |

| Down Payment | $0 – $10,000 (often 0-10% of truck value) | Some programs require no money down, while others ask for a modest upfront payment. Higher down payments can reduce monthly payments and total cost. |

| Monthly Payment | $1,500 – $3,500+ (depending on truck value, lease term, interest rate, and down payment) | This includes principal and "interest" (often baked into the lease rate). Higher-value trucks or shorter terms lead to higher payments. |

| Lease Term | 24 – 60 months (2-5 years) | Shorter terms mean higher monthly payments but faster ownership. Longer terms reduce monthly payments but increase total cost and risk of maintenance issues. |

| Buyout/Residual | $5,000 – $30,000 (typically 10-25% of original truck value, or a fixed amount) | The amount you pay at the end to own the truck. It reflects the estimated remaining value of the truck. This can be a fixed amount or a percentage. |

| Total Estimated Cost | $60,000 – $210,000+ (Down Payment + (Monthly Payment x Lease Term) + Buyout) | This is the sum of all payments made over the life of the lease, plus the buyout. It will generally be higher than the initial truck value due to the cost of financing. Always calculate this before committing. |

| Additional Costs | Insurance: $500-$1,200/month; Maintenance: $0.15-$0.25/mile; Permits/Licenses: Varies | These are essential operating costs in addition to your lease payments. Never overlook them in your budgeting. |

Frequently Asked Questions (FAQ)

Q1: Is lease-to-own better than buying a semi-truck outright or with a traditional loan?

A1: It depends on your financial situation. If you have excellent credit, a substantial down payment, and prefer immediate full ownership, a traditional loan might be cheaper in the long run. Lease-to-own is ideal if you have limited capital, want to build credit, or prefer a lower upfront commitment while working towards ownership.

Q2: What kind of credit score do I need for a lease-to-own semi-truck?

A2: Requirements vary. Some programs cater to individuals with less-than-perfect credit (e.g., scores in the 500s or 600s), while others prefer higher scores (650+). Your driving history, business plan, and trucking experience also play a significant role.

Q3: Can I use my own mechanic for maintenance during the lease term?

A3: This depends on the specific lease agreement. Some lessors require you to use their approved service centers or specific mechanics to ensure quality and track maintenance. Others may allow you to use your own, provided they are certified and you keep detailed records. Always clarify this in the contract.

Q4: What happens if I miss a payment?

A4: Missing payments can have severe consequences, including late fees, damage to your credit score, and potentially repossession of the truck. It’s crucial to communicate with your lessor immediately if you anticipate difficulty making a payment.

Q5: Can I return the truck early if I don’t want to buy it or if my business fails?

A5: Early termination clauses vary widely and can be very costly. Many agreements include significant penalties or require you to pay a substantial portion of the remaining lease payments. Always understand these clauses before signing.

Q6: Is insurance included in the lease-to-own payments?

A6: Rarely. In most lease-to-own agreements, you are responsible for obtaining and maintaining your own comprehensive commercial truck insurance coverage, which can be a significant monthly expense.

Q7: What is a "balloon payment" in a lease-to-own context?

A7: A balloon payment is often synonymous with the "residual value" or "buyout price." It’s a large, lump-sum payment due at the very end of the lease term if you choose to purchase the truck. It’s the final amount needed to transfer ownership to you.

Conclusion

Lease to own semi trucks for sale represents a viable and often necessary path for many aspiring owner-operators and growing trucking businesses. It offers a structured way to get behind the wheel, build equity, and eventually own a valuable asset without the prohibitive upfront costs of traditional purchasing. While it comes with its own set of responsibilities and potential challenges, meticulous research, careful financial planning, and a thorough understanding of the contract terms can pave the way for a successful journey from lessee to proud semi-truck owner. By approaching this decision with diligence and an informed perspective, you can confidently navigate the highway to your trucking dreams.