Repo Tow Trucks For Sale Near Me: A Comprehensive Guide to Smart Acquisitions pickup.truckstrend.com

The world of commercial vehicles can be an expensive one, especially when you’re looking to acquire specialized equipment like tow trucks. For entrepreneurs starting a towing business, expanding an existing fleet, or simply seeking a cost-effective solution, the phrase "Repo Tow Trucks For Sale Near Me" often sparks curiosity and hope. Repossessed tow trucks represent a unique segment of the used vehicle market, offering the potential for significant savings on essential equipment. But what exactly are they, and how can you navigate this market to find the best deal without falling into common pitfalls?

This comprehensive guide will demystify the process of finding and purchasing repo tow trucks, providing you with the knowledge, tips, and practical advice needed to make an informed decision. From understanding the origins of these vehicles to the critical steps of inspection and negotiation, we’ll cover everything you need to know to potentially secure a valuable asset for your operations.

Repo Tow Trucks For Sale Near Me: A Comprehensive Guide to Smart Acquisitions

What Exactly Are "Repo" Tow Trucks?

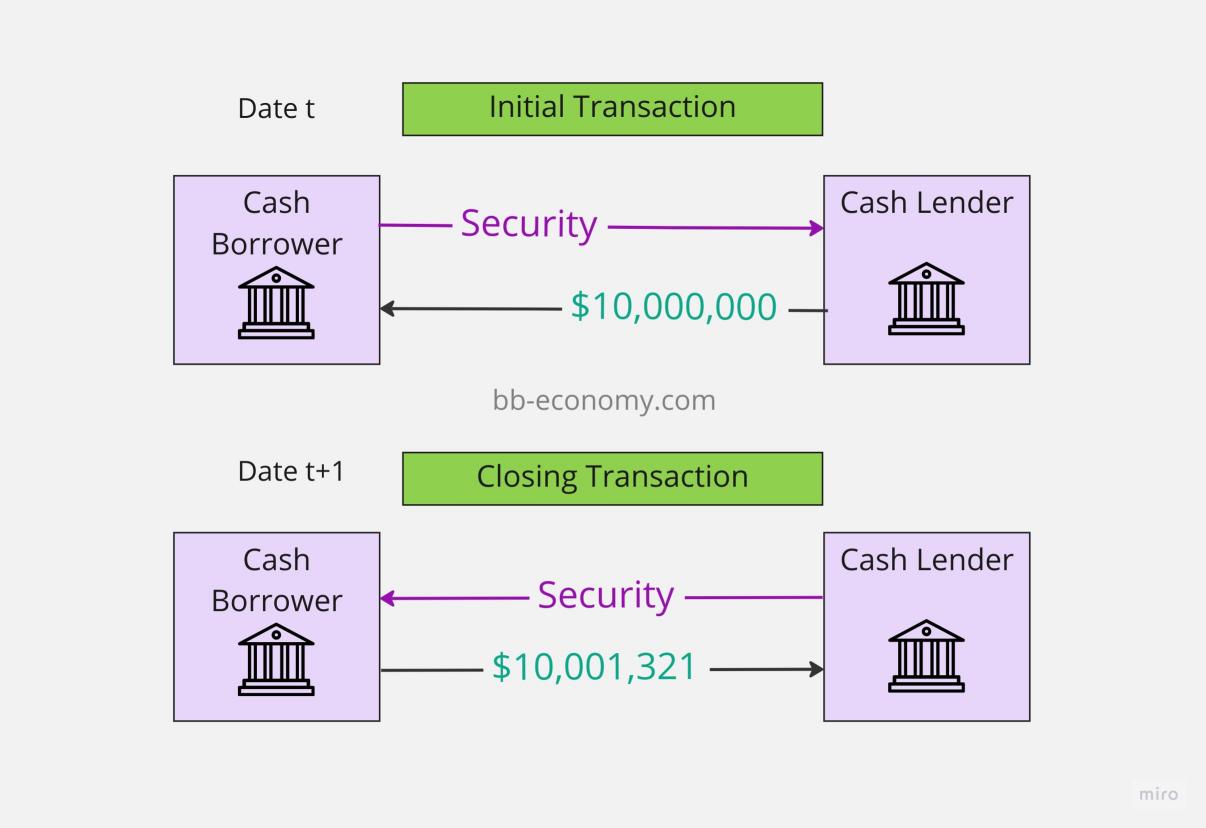

"Repo" is short for "repossessed," meaning these vehicles have been taken back by a lender (such as a bank, credit union, or financing company) due to the borrower’s default on their loan payments. In the context of tow trucks, this often means the previous owner, perhaps a towing company or independent operator, was unable to meet their financial obligations.

Once repossessed, lenders typically aim to recover their losses by selling the asset quickly. This urgency can translate into lower prices for buyers, making repo tow trucks an attractive option compared to purchasing new or even standard used models from dealerships. These trucks can range from nearly new with low mileage to older models with extensive wear, offering a diverse spectrum of choices for various budgets and operational needs. The importance and relevance of exploring "Repo Tow Trucks For Sale Near Me" lies precisely in this potential for significant cost savings and quicker acquisition, allowing businesses to scale or start up with less initial capital outlay.

Where to Find Repo Tow Trucks For Sale Near Me

Locating repossessed tow trucks requires a targeted approach, as they aren’t typically found on standard used car lots. Here are the primary avenues to explore:

-

Bank and Lender Websites/Portals: Many financial institutions that handle commercial vehicle loans have dedicated "asset recovery" or "repossession" sections on their websites. These portals list repossessed vehicles for sale, often directly or through designated remarketing partners. Checking the websites of major commercial lenders and local banks is a great starting point.

-

Online Auction Platforms:

- Government Auctions: Sometimes, federal or state agencies seize assets, including tow trucks, which are then auctioned off to the public. Websites like GSA Auctions (for federal assets) can be a source.

- Bank/Lender Specific Auctions: Many banks use specialized online auctioneers to offload repossessed assets. These auctions can be open to the public or require registration.

- General Heavy Equipment & Vehicle Auctions: Websites like Proxibid, Ritchie Bros., IronPlanet, and GovDeals frequently feature commercial vehicles, including tow trucks, that may have been repossessed.

- Auto Auctions (Public & Dealer-Only): While many auto auctions focus on passenger vehicles, some larger ones have commercial sections. Some "dealer-only" auctions might be accessible through a licensed dealer you know.

-

Specialized Repossession Companies & Remarketers: These companies handle the actual repossession and often the subsequent sale of the vehicles on behalf of lenders. They may have their own sales lots or list vehicles on their websites. A quick online search for "repossessed vehicle sales [your state/city]" can yield results.

-

Online Marketplaces & Classifieds:

- Commercial Truck & Equipment Websites: Sites like TruckPaper.com, CommercialTruckTrader.com, and MyLittleSalesman.com are dedicated to commercial vehicle sales and often list repossessed or lender-owned trucks alongside standard listings.

- General Classifieds: Craigslist, Facebook Marketplace, and eBay Motors can sometimes feature repo tow trucks, though you’ll need to filter carefully and be wary of scams. Look for listings explicitly mentioning "bank-owned," "repo," or "lender liquidation."

-

Local Dealerships Specializing in Used Commercial Vehicles: Some dealerships have relationships with banks and acquire repossessed vehicles directly. While they may mark up the price, they often perform basic inspections and necessary repairs, offering a slightly less "as-is" purchase.

-

Word-of-Mouth and Networking: Informing other towing operators, mechanics, and commercial vehicle professionals in your area that you’re looking for a repo tow truck can sometimes lead to valuable leads.

Types of Repo Tow Trucks You Might Find

The type of tow truck available as a repo will largely depend on what was repossessed. You can find virtually any type:

- Light-Duty Wreckers (Hook & Chain/Wheel-Lift): Ideal for cars, small SUVs, and motorcycles. Often the most common and affordable repo options.

- Medium-Duty Wreckers: Suitable for larger SUVs, vans, and light commercial trucks. A versatile option for many operations.

- Heavy-Duty Wreckers (Rotators/Integrated): Designed for semi-trucks, buses, and heavy equipment. These are significantly more expensive, even as repos, but offer immense recovery power.

- Flatbed/Rollback Tow Trucks: Excellent for damage-free towing of all vehicle types, from luxury cars to light commercial trucks. Highly sought after.

- Integrated/Self-Loader Tow Trucks: A specific type of wheel-lift where the boom and subframe are integrated, often used for quick, efficient urban towing.

When considering a repo, assess which type best fits your business model and the types of vehicles you intend to tow.

Key Considerations Before Buying a Repo Tow Truck

Purchasing a repossessed tow truck can be a smart financial move, but it comes with unique risks. Due diligence is paramount.

-

Thorough Condition Assessment ("As-Is" Sales): Most repo sales are "as-is, where-is," meaning no warranties or guarantees. This makes a comprehensive inspection crucial.

- Mechanical Inspection: Have a qualified heavy-duty mechanic inspect the engine, transmission, brakes, suspension, steering, and all fluid levels. Check for leaks, unusual noises, and error codes.

- Hydraulic System: Inspect the boom, winch, wheel-lift, and all hydraulic lines, cylinders, and pumps for leaks, cracks, and smooth operation. Test all functions repeatedly.

- Frame and Body: Look for rust, especially on the frame rails, subframe, and critical structural components. Check for signs of accident damage or poor repairs.

- Electrical System: Test all lights, gauges, switches, and auxiliary power units. Ensure the PTO (Power Take-Off) engages properly.

- Tires: Assess tire condition, tread depth, and uneven wear, which could indicate alignment issues.

- Auxiliary Equipment: Verify all accessories like dollies, chains, straps, and recovery tools are present and in good condition if included in the sale.

-

Vehicle History Report (VIN Check): Obtain a comprehensive vehicle history report (e.g., from CARFAX or a commercial VIN checker). This can reveal:

- Previous accidents or damage.

- Salvage or flood titles.

- Odometer discrepancies.

- Number of previous owners.

- Service and maintenance history (though often incomplete for commercial vehicles).

-

Legal & Title Issues: Verify that the title is clear and free of any liens. The selling entity (bank, auction house) should be able to provide a clear title upon purchase. Be wary of any seller who cannot produce a clear title.

-

Budget Beyond Purchase Price: Factor in potential post-purchase costs:

- Repairs: Assume you’ll need to make some repairs, even if minor.

- Maintenance: Immediate servicing (oil change, filters, fluid top-offs).

- Registration and Licensing: Fees vary by state and vehicle weight.

- Insurance: Commercial vehicle insurance can be significant.

- Transportation: If the truck isn’t drivable or is far away.

-

Match to Your Purpose: Don’t get swayed by a low price if the truck doesn’t meet your operational needs. A cheap light-duty wrecker won’t help if you primarily tow heavy commercial vehicles.

-

Mileage and Age: While lower mileage is generally better, for commercial trucks, consistent maintenance is often more critical than age or mileage alone. A high-mileage truck with excellent maintenance records might be a better buy than a low-mileage truck that was neglected.

The Buying Process: A Step-by-Step Guide

- Define Your Needs and Budget: Before you start looking, know what type of tow truck you need, what features are essential, and your absolute maximum budget, including potential repair costs.

- Research Sources: Utilize the avenues listed above ("Where to Find…") to identify potential listings near you or within a reasonable travel distance.

- Identify Potential Trucks: Shortlist trucks that broadly meet your criteria.

- Thoroughly Inspect (or Hire an Inspector): This is the most critical step. If you’re not an expert, hire a professional mechanic specializing in heavy equipment or commercial trucks to perform a pre-purchase inspection. Do not skip this!

- Check VIN/History: Obtain and review the vehicle history report.

- Bid/Negotiate:

- For Auctions: Understand the auction rules, buyer’s premiums, and payment terms. Set a maximum bid and stick to it. Don’t get caught in a bidding war.

- For Direct Sales (Banks/Remarketers): Negotiate the price. Be prepared to walk away if the price isn’t right or if the seller is unwilling to address concerns.

- Secure Financing (If Needed): Get pre-approved for a loan if you’re not paying cash. Lenders may be more hesitant to finance "as-is" repo vehicles, so explore specialized commercial vehicle lenders.

- Complete Paperwork: Ensure you receive a clear title, a bill of sale, and any other necessary documentation for registration.

- Transport the Truck: Arrange for transportation if the truck is not drivable or if you’re buying out of state.

Potential Challenges and Solutions

- "As-Is" Sales:

- Challenge: Most repo sales offer no warranty, meaning any issues discovered after purchase are your responsibility.

- Solution: Comprehensive pre-purchase inspection by a qualified professional is non-negotiable. Factor in a contingency budget for immediate repairs.

- Hidden Problems:

- Challenge: Previous neglect or undisclosed issues can lead to expensive surprises.

- Solution: Combine a thorough mechanical inspection with a detailed vehicle history report. Be extra cautious if the truck looks unusually clean for its age/mileage or if the seller is evasive about its past.

- Lack of Maintenance Records:

- Challenge: Repossessed vehicles often come with little to no service history.

- Solution: Rely heavily on the physical inspection. Assume all fluids need changing, and plan for a full preventative maintenance service immediately after purchase.

- Competitive Bidding (Auctions):

- Challenge: Desirable trucks can attract many bidders, driving up prices.

- Solution: Set a strict maximum bid based on your budget and the truck’s estimated value. Don’t get emotionally invested. Be prepared to lose a bid and wait for the next opportunity.

- Title Issues:

- Challenge: Occasionally, a repossessed vehicle might have a clouded title or outstanding liens if the lender’s process wasn’t complete.

- Solution: Verify the title’s clarity before completing the purchase. Reputable sellers (banks, established auction houses) will ensure a clean title.

Tips for a Successful Purchase

- Be Patient: The right repo tow truck at the right price may not appear overnight.

- Do Your Homework: Research market values for similar trucks to recognize a good deal.

- Don’t Skip the Inspection: This cannot be stressed enough. It’s your primary defense against costly mistakes.

- Factor in Post-Purchase Costs: A cheap purchase price can quickly become expensive if you haven’t budgeted for repairs, maintenance, and setup.

- Understand Auction Rules: If buying at auction, familiarize yourself with the terms, fees, and payment deadlines.

- Network: Talk to other tow truck operators. They might know about upcoming sales or have insights into local market conditions.

Typical Price Ranges for Repo Tow Trucks (Estimates)

It’s crucial to understand that prices for "Repo Tow Trucks For Sale Near Me" are highly variable. They depend on the truck’s type, age, mileage, condition, specific features, location, and the urgency of the sale. The following table provides estimated ranges to give you a general idea, but always conduct your own market research for current local prices.

| Truck Type | Typical Condition (Repo) | Estimated Price Range (USD) | Key Factors Affecting Price |

|---|---|---|---|

| Light-Duty Wrecker | Fair to Good | $10,000 – $35,000 | Age, mileage, boom type (hook/chain vs. wheel-lift), condition of hydraulic system, rust. |

| Medium-Duty Wrecker | Fair to Good | $25,000 – $60,000 | Engine/transmission health, boom capacity, wrecker body manufacturer, overall wear. |

| Flatbed/Rollback | Good to Excellent | $30,000 – $80,000 | Bed length/capacity, winch power, condition of ramps/hydraulics, cab features. |

| Heavy-Duty Wrecker | Good | $70,000 – $200,000+ | Rotator vs. Integrated, boom reach/capacity, axle configuration, engine hours, specialized recovery equipment. |

| Integrated/Self-Loader | Good to Very Good | $20,000 – $50,000 | Chassis condition, speed of deployment, hydraulic system integrity, urban vs. highway suitability. |

Note: These are broad estimates. A very old or severely damaged repo truck might sell for significantly less, while a nearly new, well-maintained repo could command prices at the higher end of these ranges or even above.

Frequently Asked Questions (FAQ)

Q: Are repo tow trucks always cheaper than other used tow trucks?

A: Generally, yes. Lenders prioritize quick recovery of funds, which often means selling at competitive prices, sometimes below market value. However, the "cheaper" price often reflects the "as-is" condition and potential for immediate repairs.

Q: Can I get financing for a repo tow truck?

A: Yes, but it can be more challenging than for a new or certified used truck. You’ll likely need a good credit score and may need to seek out specialized commercial vehicle lenders or credit unions that are accustomed to financing "as-is" assets. Be prepared for potentially higher interest rates or larger down payments.

Q: Is it risky to buy a repo tow truck?

A: There are inherent risks due to the "as-is" nature of most sales and the potential lack of maintenance history. However, these risks can be significantly mitigated by conducting a thorough pre-purchase inspection by a qualified mechanic and reviewing a detailed vehicle history report.

Q: How do I verify the mileage on a repo truck?

A: Always check the odometer against the vehicle history report (VIN check). Discrepancies should be a major red flag. A physical inspection by a mechanic might also reveal signs of excessive wear inconsistent with the odometer reading.

Q: What paperwork do I need to buy one?

A: You’ll typically need a clear title from the selling entity (bank, auction house) and a bill of sale. Depending on your state, you might also need an odometer disclosure statement. Ensure all documents are properly filled out and notarized if required.

Q: Do repo trucks come with a warranty?

A: Almost never. The vast majority of repo sales are "as-is, where-is," meaning the buyer assumes all responsibility for the vehicle’s condition after the sale. This is why inspection is so critical.

Q: What’s the best time to buy a repo tow truck?

A: There’s no single "best" time. Repossessions happen year-round. However, sometimes at the end of fiscal quarters or year-end, lenders might be more motivated to clear inventory, potentially leading to better deals. Attending a larger, multi-lender auction can also increase your chances of finding a suitable vehicle.

Concluding Summary

Purchasing a repo tow truck can be an incredibly strategic move for your business, offering a pathway to acquire vital equipment at a fraction of the cost of new. The journey from "Repo Tow Trucks For Sale Near Me" to a valuable addition to your fleet requires diligence, patience, and an informed approach. By understanding what these vehicles are, knowing where to find them, and meticulously performing your due diligence—especially a comprehensive mechanical inspection—you can navigate the market effectively. While challenges exist, the potential for significant savings and rapid fleet expansion makes the repossessed tow truck market a compelling avenue for smart entrepreneurs. Equip yourself with knowledge, inspect with rigor, and you’ll be well on your way to securing a deal that drives your business forward.