Repo Trucks For Sale Near Me: Your Comprehensive Guide to Unlocking Value pickup.truckstrend.com

The search for an affordable, reliable vehicle can often lead down various paths, but few offer the potential for significant savings quite like the market for repossessed trucks. When you search for "Repo Trucks For Sale Near Me," you’re tapping into a unique segment of the automotive market where financial institutions, government agencies, and even private sellers liquidate vehicles that have been repossessed due to loan defaults. This guide aims to be your definitive resource, navigating the intricacies of finding, evaluating, and purchasing a repo truck, helping you uncover genuine value close to home.

Repo trucks represent a fascinating intersection of opportunity and caution. For individuals, small businesses, or contractors in need of a robust workhorse without the hefty price tag of a new or traditional used vehicle, a repossessed truck can be an ideal solution. They come in all shapes and sizes – from light-duty pickups perfect for personal use, to heavy-duty work trucks, commercial box trucks, and even specialized utility vehicles. The primary allure is, of course, the price: often significantly lower than comparable models found through conventional dealerships. However, the "near me" aspect emphasizes convenience and the ability to physically inspect the vehicle, a critical step in making an informed purchase.

Repo Trucks For Sale Near Me: Your Comprehensive Guide to Unlocking Value

Understanding Repo Trucks: What Exactly Are They?

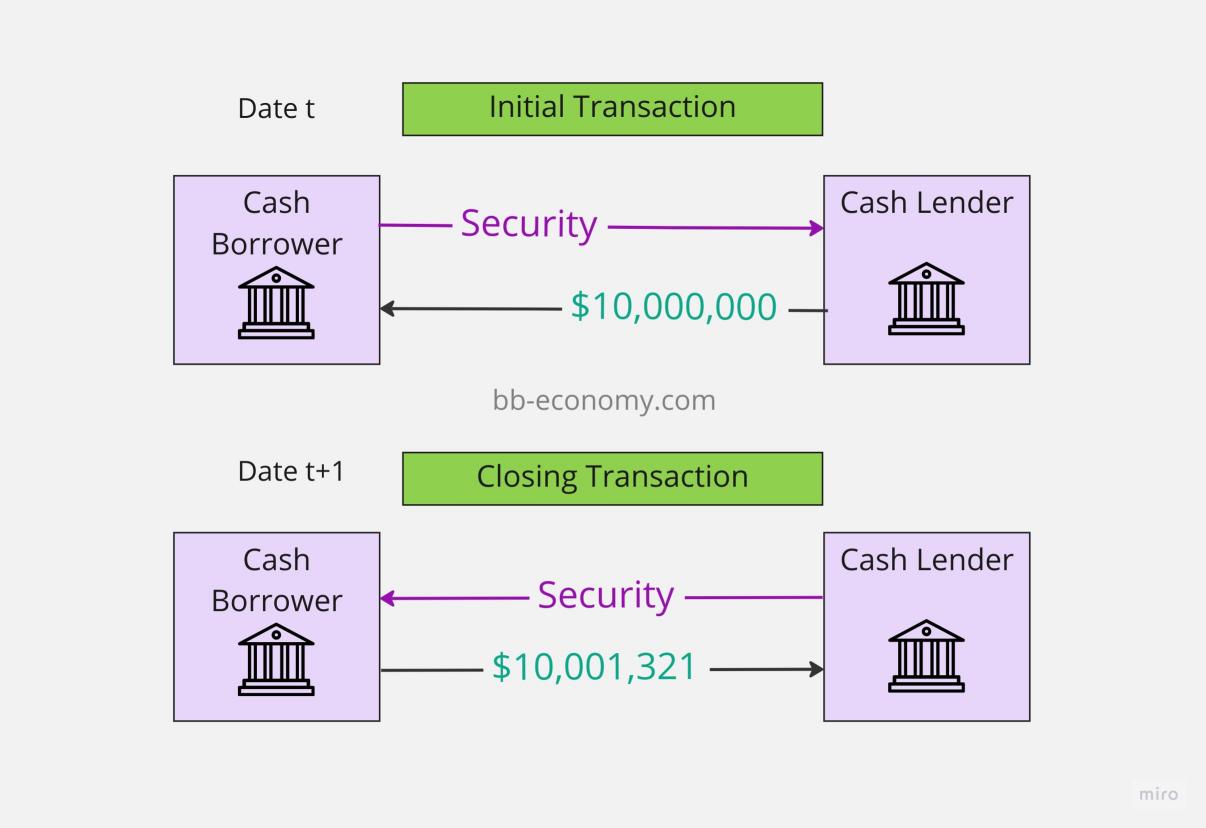

At its core, a repossessed truck is a vehicle that has been seized by a lender (such as a bank, credit union, or finance company) because the borrower failed to make their agreed-upon loan payments. Once the repossession process is complete and the title is cleared, the lender’s primary goal is to recover as much of the outstanding loan amount as possible by selling the asset quickly.

These trucks enter the market through various channels: direct sales by financial institutions, public auctions (both online and physical), or sometimes through specialized dealerships that acquire repossessed inventory. Unlike a traditional used car dealership where vehicles are typically reconditioned and come with some form of warranty, repo trucks are often sold "as-is," with little to no reconditioning and no warranty. This "buyer beware" nature is precisely why they are priced more competitively, offering a substantial discount to those willing to undertake the necessary due diligence.

The Allure of Repossessed Trucks: Why Buy One?

The decision to purchase a repo truck is often driven by several compelling advantages:

- Significant Cost Savings: This is the paramount benefit. Repo trucks are priced to sell quickly, meaning you can often acquire a vehicle for thousands less than its retail market value. This savings can be critical for budget-conscious buyers or new businesses trying to minimize initial capital outlay.

- Wide Variety of Options: The repossessed market is diverse. You can find everything from popular light-duty models like Ford F-150s, Chevrolet Silverados, and Ram 1500s, to more robust F-250s/350s, commercial vans, and even specialized vocational trucks. The sheer volume of repossessions ensures a constant, rotating inventory, increasing your chances of finding the perfect "Repo Trucks For Sale Near Me."

- Quick Availability: Unlike waiting for a new truck order or navigating lengthy dealership processes, repo trucks are typically available for immediate purchase. This can be a huge advantage if you need a vehicle quickly for a new job or project.

- Potential for High Value: With careful inspection and a bit of luck, you can unearth a gem – a well-maintained truck that simply had an unfortunate previous owner. Such finds represent exceptional value, allowing you to get more truck for your money.

Where to Find Repo Trucks For Sale Near Me

Locating repossessed trucks requires knowing the right channels. The "near me" aspect means focusing on local resources and online platforms that allow geographical filtering.

- Financial Institutions (Banks & Credit Unions): Many banks and credit unions directly list their repossessed assets on their websites under sections like "Repossessed Vehicles," "REO (Real Estate Owned) & Repossessed Assets," or "Used Car Sales." This is often a good starting point as they might offer more transparent information than an auction.

- Online Repo Marketplaces: Dedicated websites like RepoDirect.com, RepoFinder.com, or specific bank repo lists aggregate repossessed vehicles from various lenders across the country. Use their search filters to narrow down "Repo Trucks For Sale Near Me."

- Public Auto Auctions:

- Government Auctions: Often sell vehicles seized by law enforcement or government agencies (e.g., GovDeals.com, local police auction sites).

- Dealer Auctions (Open to Public): Some large auto auction houses (e.g., Manheim, ADESA, IAAI – though primarily for dealers, some have public days or online public sales) list repossessed vehicles. Check their local schedules.

- Local Towing/Impound Auctions: Unclaimed vehicles from impound lots are often auctioned off. Check your local police or sheriff’s department websites.

- General Online Classifieds: Websites like Craigslist, Facebook Marketplace, and eBay Motors (with "Repo" or "Bank Owned" as keywords) can list individual repo trucks. Exercise extreme caution and verify sellers’ credibility.

- Used Car Dealerships: Some dealerships specialize in acquiring and reselling repossessed vehicles. While they might mark up the price, they often perform some reconditioning and might offer limited warranties, reducing some of the "as-is" risk.

Navigating the Purchase Process: A Step-by-Step Guide

Once you’ve identified potential "Repo Trucks For Sale Near Me," follow these steps for a successful purchase:

- Define Your Needs and Budget: Before you even start looking, know what kind of truck you need (payload, towing capacity, cab style, fuel type) and set a strict budget. Remember to factor in potential repair costs, registration, and insurance.

- Locate Potential Vehicles: Use the resources listed above. Create a shortlist of trucks that meet your criteria.

- Thorough Pre-Purchase Inspection (PPI) is Paramount: This is the most critical step.

- Physical Inspection: If possible, visit the location. Check for rust, body damage, tire wear, fluid leaks, dashboard warning lights, and interior condition.

- Professional Mechanic: For any serious contender, arrange for a trusted mechanic to perform a comprehensive inspection. They can identify hidden mechanical issues that might be costly.

- VIN Check: Run a Vehicle Identification Number (VIN) report through services like CarFax or AutoCheck. This can reveal accident history, flood damage, salvage titles, odometer fraud, and previous ownership details. Be aware that repo vehicles sometimes have incomplete service histories.

- Understand the Sale Terms: Most repo trucks are sold "as-is, where-is," meaning no warranty and no recourse for issues discovered after purchase. Read all terms and conditions, especially for auctions.

- Bidding or Negotiating:

- Auctions: Set a maximum bid beforehand and stick to it. Don’t get caught in a bidding war. Be prepared for a quick decision.

- Direct Sales (Banks/Dealers): Research comparable market values to negotiate effectively. Cash offers are often preferred and can give you leverage.

- Financing and Payment: Cash is king in the repo market. If you need financing, be aware that traditional lenders might be hesitant to finance "as-is" vehicles or may offer higher interest rates. Explore credit union loans or personal loans if necessary.

- Paperwork and Title Transfer: Ensure you receive a clear title free of liens. Verify all paperwork matches the vehicle’s VIN. Understand your local Department of Motor Vehicles (DMV) requirements for title transfer and registration.

Important Considerations Before Buying a Repo Truck

While the savings are attractive, there are critical factors to weigh:

- "As-Is" Sales: This cannot be stressed enough. You are buying the vehicle exactly as it sits, with no guarantees. Any repairs become your responsibility.

- Limited or No Vehicle History: Repossessed vehicles often come with little to no service records. The VIN check is your best tool, but it’s not always exhaustive.

- Condition Variability: The condition of repo trucks can range from nearly new with minor cosmetic flaws to heavily used, neglected, or even non-running. Factor in potential repair costs when evaluating the overall deal.

- Hidden Damage: Be wary of signs of flood damage (musty smell, rust in unusual places, water lines) or significant accident history that wasn’t properly repaired.

- No Test Drive at Auctions: Many auctions do not allow test drives, only static inspection. This increases the risk significantly.

Tips for a Successful Repo Truck Purchase

To maximize your chances of a positive outcome:

- Be Patient and Persistent: The right truck at the right price might not appear immediately.

- Set a Hard Budget Limit: Include potential repair costs and stick to it. Overbidding at an auction can quickly negate any savings.

- Bring a Knowledgeable Friend or Mechanic: Especially if you’re not mechanically inclined. A second pair of eyes, particularly experienced ones, is invaluable.

- Inspect Everything Thoroughly: From engine noises to tire tread, interior wear, and electrical components.

- Verify the VIN: Always cross-reference the VIN on the truck with the VIN on the title and any online reports.

- Factor in All Costs: Purchase price, auction fees (if applicable), sales tax, registration, insurance, and anticipated repairs.

- Read the Fine Print: Understand the terms of sale, especially at auctions where rules can be strict and non-negotiable.

Challenges and Solutions in the Repo Market

| Challenge | Solution |

|---|---|

| Unknown Vehicle History | Solution: Always perform a comprehensive VIN check (CarFax, AutoCheck). While not always complete for repo vehicles, it’s the best available tool. Prioritize trucks with some documented history if possible. |

| "As-Is" Condition & Hidden Problems | Solution: Crucial pre-purchase inspection by a qualified mechanic. Budget a contingency fund for potential repairs. If you can’t get a professional inspection, be prepared to walk away from a deal that seems too risky. |

| Fierce Competition at Auctions | Solution: Research market values beforehand and set a strict maximum bid. Don’t get emotionally involved in bidding wars. Be prepared to let a truck go if the price exceeds your rational limit. |

| Potential for Scams | Solution: Stick to reputable sources (known banks, established auction houses). Be wary of deals that seem too good to be true, requests for wire transfers, or sellers unwilling to allow physical inspection. Always verify ownership and clear title. |

| No Test Drive Available | Solution: For vehicles where a test drive isn’t possible (common at auctions), rely heavily on a thorough static inspection by a mechanic. Check for fluid leaks, strange engine noises when started, and electrical functionality. The risk is higher, so adjust your potential bid accordingly. |

| Limited Financing Options | Solution: Secure pre-approved financing from a bank or credit union that is comfortable lending on "as-is" vehicles, or be prepared to pay cash. Some specialized lenders might cater to this market but often with higher interest rates. |

Representative Price Table: Repo Trucks For Sale Near Me

It’s important to note that actual prices for "Repo Trucks For Sale Near Me" vary significantly based on location, specific vehicle condition, mileage, year, make, model, and the entity selling it. This table provides estimated ranges to give you a general idea of what to expect in the repo market. Always perform your own research for specific vehicles.

| Truck Type / Category | Typical Condition Range | Estimated Repo Price Range (USD) | Notes |

|---|---|---|---|

| Light-Duty Pickups | |||

| Ford F-150, Chevy Silverado 1500, Ram 1500 (5-10 yrs old) | Fair to Good (minor cosmetic, some wear) | $8,000 – $18,000 | Most common, high demand. Prices vary based on mileage, trim, engine. Often popular choices for personal or light work use. |

| Ford Ranger, Chevy Colorado (5-10 yrs old) | Good (well-maintained for age) | $7,000 – $15,000 | Smaller, more fuel-efficient. Ideal for lighter tasks or city driving. |

| Heavy-Duty Pickups | |||

| Ford F-250/350, Chevy Silverado 2500/3500, Ram 2500/3500 (5-10 yrs old) | Fair to Average (some dents, higher mileage) | $15,000 – $30,000 | Work trucks, often higher mileage. Diesel models typically fetch higher prices due to durability and towing capacity. |

| Commercial/Utility Trucks | |||

| Box Trucks (e.g., Ford E-Series, GMC Savana Cutaway) | Poor to Fair (heavy wear, potential mechanical) | $10,000 – $25,000 | Often ex-fleet vehicles. Condition highly variable; pre-purchase inspection is crucial due to heavy use. |

| Flatbed/Stake Body Trucks | Fair to Good (used for specific jobs) | $12,000 – $28,000 | Less common in repo market, niche appeal. Check for structural integrity of the bed. |

| Specialty Trucks/Vans | |||

| Work Vans (e.g., Ford Transit, Sprinter) | Fair to Good (used for delivery/service) | $8,000 – $20,000 | Popular for small businesses, often come with shelving or racks. Check for cargo area damage. |

| Smaller Dump Trucks (Commercial) | Poor to Average (heavy use, likely repairs needed) | $20,000 – $40,000+ | Less frequent on the general repo market, often found at heavy equipment auctions. Require significant inspection due to specialized equipment. |

| Key Considerations Affecting Price | |||

| Mileage | Lower vs. Higher | Lower price for high mileage | High mileage generally indicates more wear and tear, thus lower value. |

| Mechanical Condition | Running vs. Needs Repair | Significant price difference | Non-running vehicles are significantly cheaper but require substantial investment in repairs. |

| Cosmetic Damage | Minor vs. Major | Affects perceived value | Dents, scratches, interior wear, and missing parts reduce the price. |

| Market Demand | Popular models vs. Niche | Higher demand, higher price | Popular models (like F-150s) tend to hold their value better even as repossessions due to consistent demand. |

| Sale Channel | Auction vs. Direct Sale | Auction often lower | Auctions generally offer lower prices but come with less opportunity for thorough inspection and are "as-is." Direct sales from banks might be slightly higher but more transparent. |

| Location | Urban vs. Rural | Prices can vary regionally | Depending on local demand, supply, and regional economic factors. |

Frequently Asked Questions (FAQ) About Repo Trucks

Q1: Are repo trucks reliable?

A1: Reliability varies widely. Some repo trucks are nearly new and well-maintained, while others may have been neglected or heavily used. The "as-is" nature means no guarantees. A thorough pre-purchase inspection by a trusted mechanic is essential to assess reliability.

Q2: Can I finance a repo truck?

A2: Yes, but it can be more challenging than financing a new or certified used vehicle. Traditional lenders may be hesitant to finance "as-is" vehicles, or they might offer higher interest rates. Credit unions are sometimes more flexible, or you may need to seek out specialized lenders who deal with repo or auction vehicles. Paying cash is often the easiest route.

Q3: Do repo trucks come with a warranty?

A3: Almost never. The vast majority of repo trucks are sold "as-is, where-is," meaning they come without any warranty, explicit or implied. This is why the price is significantly lower, and why your pre-purchase inspection is so crucial.

Q4: What’s the best place to find "Repo Trucks For Sale Near Me"?

A4: It depends on your comfort level. For transparency and direct contact, check local bank and credit union websites. For the widest selection and potentially lowest prices, online and physical auto auctions are key. General online classifieds can yield results but require extra caution against scams.

Q5: How do I know if a repo truck is a good deal?

A5: A good deal means the repo price, plus any anticipated repair costs, is still significantly less than the market value of a comparable truck in similar condition. Research the market value of the specific make, model, and year you’re interested in, then factor in the "as-is" risk and potential repair expenses.

Q6: Can I test drive a repo truck before buying?

A6: It depends on the seller. If buying directly from a bank or a dealership that specializes in repos, a test drive is often possible and highly recommended. At most public auctions, test drives are usually not permitted; you’ll be limited to a static inspection and starting the engine (if allowed).

Q7: What paperwork do I need to buy a repo truck?

A7: You’ll typically need valid identification, proof of funds (for cash purchases), or pre-approved loan documents. Upon purchase, ensure you receive a clear title free of liens, a bill of sale, and any other necessary documents for transferring ownership and registering the vehicle in your state.

Conclusion

The pursuit of "Repo Trucks For Sale Near Me" can be an incredibly rewarding endeavor, offering a gateway to significant savings on a vital asset. Whether you’re a small business owner needing a reliable work vehicle or an individual looking for a robust pickup, the repossessed market holds immense potential.

However, success in this market hinges entirely on informed decision-making and meticulous due diligence. By understanding what repo trucks are, where to find them, and how to navigate the purchase process with a critical eye, you can mitigate the risks associated with "as-is" sales. Prioritize thorough inspections, set clear budgets, and don’t be afraid to walk away from a questionable deal. With the right approach, your search for a repo truck can lead to not just a vehicle, but a truly smart investment that delivers value for years to come.